By James W. Watkins, III, J.D., CFP Board Emeritus™, AWMA®

[A] fiduciary shall discharge that person’s duties with respect to the plan solely in the interests of the participants and beneficiaries; for the exclusive purpose of providing benefits to participants and their beneficiaries and defraying reasonable expenses of administering the plan; and with the care, skill, prudence, and diligence under the circumstances then prevailing that a prudent person acting in a like capacity and familiar with such matters would use in the conduct of an enterprise of a like character and with like aims.1

The Department of Labor recently filed an amicus brief in the pending Home Depot 401(k) litigation. The DOL summed up a fiduciary’s duties vis-à-vis cost-consciousness perfectly, citing several provisions from the Restatement, including the following:

The judgement and diligence required of a fiduciary in deciding to offer any particular investment must include consideration of costs, among other factors, because a trustee ‘must incur only costs that are reasonable in amount and appropriate to the investment responsibilities of the trusteeship.’2

Both references emphasized the importance of reasonable costs. A fiduciary’s duty in terms of controlling costs is a consistent theme throughout the Restatement, specifically Section 90, more commonly known as the “Prudent Investor Rule.” Comments b, f, and h(2) are key sections of in understanding and interpreting Section 90:

At first glance, the issue of reasonable expenses would seem to be fairly straightforward, i.e., cost-efficiency, benefits exceed associated costs However, upon closer examination, cost issues are arguably potentially more complicated, especially in connection with more complicated investments such as annuities, which often lack the transparency of other investments. As a result, plan sponsors may mistakenly believe they understand an investment and its costs, while closer examination often reveals issues they had not initially considered.

In his classic, “Winning the Loser’s Game,”3 investment icon Charles D. Ellis discusses various alternative ways of interpreting fees and other costs. Ellis argues that the proper way to measure or describe fees is not as a percentage of assets since customers bring the assets with them when they invest.

Ellis argues that fees should be based and evaluated on a value-added basis using the returns provided by the investment manager. Ellis provides several examples to demonstrate how using a value-added approach provides a significantly different picture in terms of fiduciary prudence.

Ellis addresses the common “only 1 percent” fee argument. However, if the expected or actual return is 7 percent, Ellis argues that the effective fee would be approximately 14 percent (1/7), not 1 percent.4

I have seen several articles recently about the annuity industry’s planned campaign to increase the use of annuities in pension plans, specifically in the form of in-plan annuities and as components in target date funds. I have consistently advised plan sponsors and other investment fiduciaries to completely avoid offering or using annuities based upon both the fact that neither ERISA and fiduciary law require them to do so, and the fact that annuities present legitimate potential fiduciary liability “traps” for investment fiduciaries.

Ellis’ value-added proposition is equally applicable to annuities. The combination of value-added analysis and “humble arithmetic provide yet another reason for plan sponsors to totally avoid annuities and the potential of unnecessary fiduciary risk liability exposure.

Annuities often impose restrictions such as cap rates and/or participation rates on the amount of annual return that the annuity owner can receive. Annuities often further reduce the annuity owner’s realized return by imposing “spreads” on the owner’s return. Spreads are totally subjective and determined unilaterally by the annuity owner.

The combination of caps rates, participation rates, and spreads often results in significantly lower returns than annuity owners were led to believe they would receive when an annuity were recommended as a means of earning “guaranteed” retirement income. This is one reason that annuities are typically in the top ten of investor complaints to regulators.

A simple example will help explain the potential fiduciary liability issues for plan sponsors who offer annuities in their plans. A common annual cap rate in annuities seems to be 10 percent. This means that whatever return the annuity issuer is able to produce, the annuity owner’s realized return is limited to just 10 percent.

The annuity owner’s realized return is then further reduced by whatever spread amount the annuity issuer decides to apply. Annuity owners are often not aware of the actual amount of spread that is applied, as annuity issuer’s often embed, or “hide,” the actual amount of the spread as part of the annuity’s pricing.

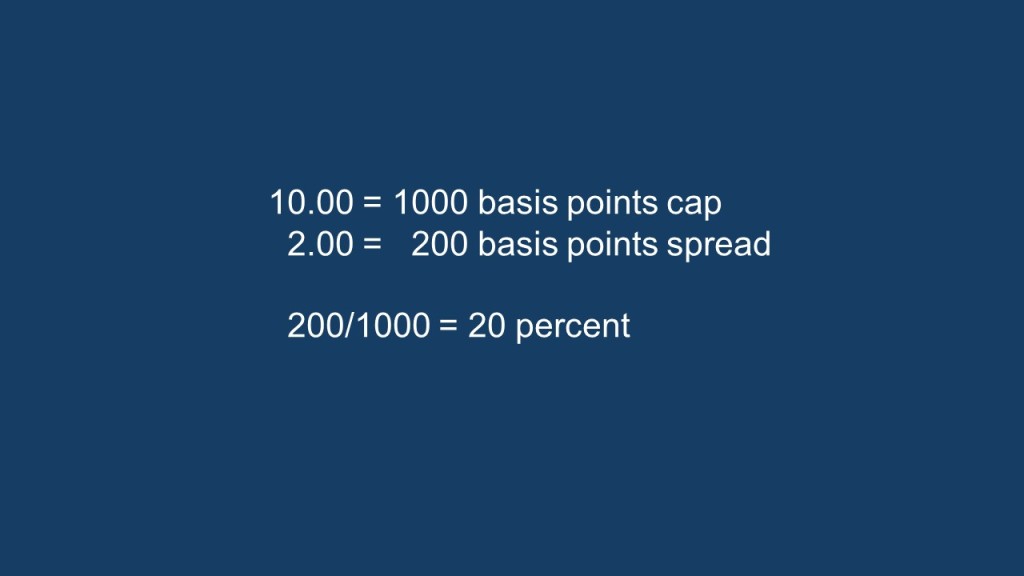

Assume a scenario involving an annuity with an annual cap rate of 10 percent and a spread of 1-2 percent. A spread of 2 percent would further reduce the annuity owner’s realized return to just 8 percent.

The potential liability issue here for a plan spsonsor is that a legitimate argument can be made that inclusion of an annuity which could produce the described scenario could result in litigation alleging a breach of the plan sponsor’s fiduciary duty of prudence. While the annuity issuer may claim that they only applied a spread of 2 percent, “humble arithmetic” paints a different picture.

Since the annuity owner’s realized returns were limited by the 10 percent cap, the argument can be made that using Ellis’ value-added proposition, the effective spread or fee/cost is effectively 20 percent instead of 2 percent.

I believe a plan sponsor would have a hard time proving the prudence of a 20 percent spread/fee/cost in connection with any investment option given the number of more cost-efficient alternatives available in the market. As I have argued in other posts, including here and here, annuities simply do not make sense from a fiduciary risk management perspective, especially when there is no legal obligation to offer them with a pension plan.

Viewed objectively, most annuities ultimately fall victim to Supreme Court Justice Louis D. Brandeis referred to as “the relentless rules of humble arithmetic.”5 Neither ERISA nor basic fiduciary law expressly require a plan spsonsor to offer any specific category of investments, e.g., annuities, actively managed mutual funds, in order to be ERISA-compliant. Prudent plan sponsors do not expose themselves to unnecessary liability risk exposure.

Notes

1. 29 U.S.C.A. Section 404a; 29 C.F.R Section 2550.404a-1(a), (b)(i) and (b)(ii).

2. Amicus Brief of the Department of Labor in Pizarro v. Home Depot, Inc., No. 22-13643 (11th Cir. 2022). (DOL Amicus Brief)

3. Charles D. Ellis, “Winning the Loser’s Game: Timeless Strategies for Successful Investing,” 8th Ed., (2021).

4. Ibid, 172.

5. Louis D. Brandeis, “Other People’s Money and How the Banks Use It,” (1914)

Copyright InvestSense, LLC 2024. All rights reserved.

This article is for informational purposes only, and is neither designed nor intended to provide legal, investment, or other professional advice since such advice always requires consideration of individual circumstances. If legal, investment, or other professional assistance is needed, the services of an attorney or other professional advisor should be sought.

You must be logged in to post a comment.