By James W. Watkins, III, J.D., CFP Board Emeritus™, AWMA®

[A] victim to the relentless rules of humble Arithmetic. Remember, O stranger, ‘Arithmetic is the first of the sciences and the mother of safety.’

U.S. Supreme Court Justice Louis Brandeis

Fiduciary law is essentially a combination of trust, agency, and equity law. A fiduciary is always required to put their beneficiaries’ interests first, to always act in their beneficiaries’ best interests. As Justice Benjamin Cardozo wrote in Meinhard v. Salmon:

A [fiduciary] is held to something stricter than the morals of the market place. Not honesty alone, but the punctilio of an honor the most sensitive, is then the standard of behavior.1

When a plaintiff’s attorney is involved in a case with catastrophic injuries, such as a wrongful death case, the defendant often suggests that the parties agree to a “structured settlement,” a settlement which usually involve some up-front money, but one in which the majority of damages are to be paid by periodic payments provided by an annuity.

People often ask me why I am so opposed to annuities. Part of my opposition to annuities is a result of my experiences with annuity wholesalers during my days as a compliance director. However, my opposition is due primarily from my experience as a plaintiff’s attorney.

When the defendant and their counsel propose a stated settlement amount, too many attorneys do not understand how to properly evaluate the value of the settlement/annuity. As a result, many plaintiff’s attorneys have faced malpractice actions for unintentionally misrepresenting the value of the settlement to their clients.

Today, many courts have addressed the fundamental fairness problem by requiring the defendant to provide the plaintiff and the court with the actual price that the defendant will have to pay for the annuity to be used in the settlement, the court taking the position that said price is the present value of the proposed settlement. Even now, some defendants refuse to disclose the actual price of the proposed annuity. In such cases, the plaintiff’s attorney can ask the court to approve a “qualified settlement fund,” into which the actual settlement funds will be temporarily deposited and then prudently invested.

The current attempt by the annuity industry to make inroads into 401(k) and 403(b) plans reminds me of the marketing ploys utilized by the annuity industry in connection with structured settlements. The annuity industry was telling the courts and anyone else who would listen that structured settlements and annuities were necessary because over 90 percent of personal-injury victims were dissipating the proceeds of their settlements within five years.

A NYU law student conducted a thorough research project and found that there was no empirical evidence to support such a claim.2 The insurance and annuity industry admitted that there was no evidence to support the claim and instructed its members to stop using the claim.

Which brings us to the current campaign by annuity advocates to increase the use of annuities within 401(k) and 403(b) plans, the advocates arguing that plan participants desire “guaranteed income for life. But do plan sponsors and plan participants understand how such annuities work and the associated costs involved. As the late fee-only insurance adviser Peter Katt used to caution, “but at what cost?”

A CEO recently contacted me and asked me why I refer to annuities as “fiduciary traps.” I showed him the analysis shown below, a structured settlement analysis that I had once prepared for a case. He looked up and told he now understood why I referred to annuities as “fiduciary traps.” He asked me why these issues were never explained to plan sponsors in this way. My response was simple – “Would you include annuities in your plan provided with such information?”

The analysis below uses methodologies included in Paul Lesti’s excellent treatise on analysis of structured settlements.3 Lesti cautioned that

Many annuities are not for a specified number of years. Most annuities are payable for the life of the annuitant, possibly with some period certain.4

Lesti notes that analyzing annuities in terms of their present value, factoring in the time value of money, is one commonly used method used in analyzing annuities. However, Lesti cautions that an analysis based on present value alone may be misleading:

The more accurate method is to calculate the present value of each probable payment.5

In the case of a nonguaranteed annuity, it is necessary to calculate the probability that the person will be alive to receive each payment. Multiply the probability by the amount to be received, and then multiply this amount by the applicable discount factor.6

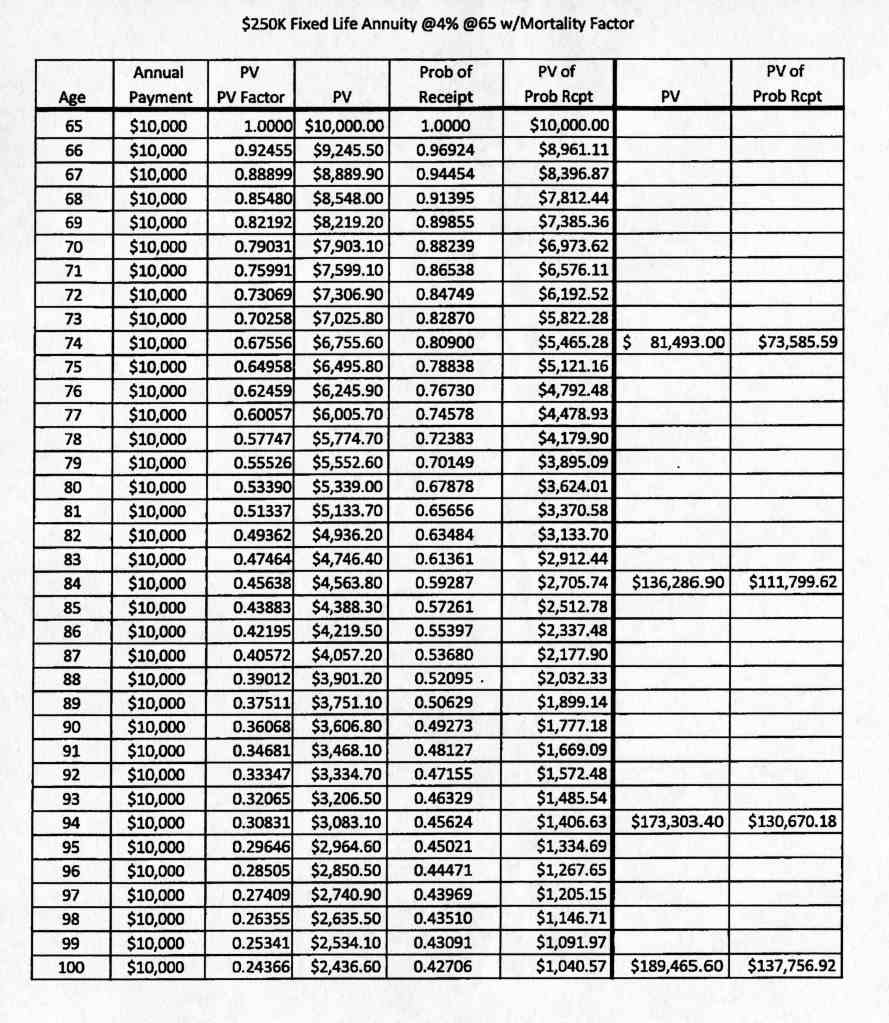

The chart below uses the suggested methodology, with a slight variation in the order of presentation to make the concept and impact of present value calculations a little easier to understand. The “twist” does not alter the end results.

As I tell my fiduciary risk management clients, always insist that the annuity salesperson provide you with a similar chart, showing the actual calculations and the breakeven point, the point at which the annuity owner could be said to receive a commensurate return on the original investment. Unless the plan participant/annuity owner will receive a commensurate return for the extra risks and costs associated with an annuity, a valid argument can be made under the common law of trusts that the investment results in a fiduciary breach due to the windfall issue. A basic tenet of equity law is that “equity abhors a windfall.”

The chart reflects an analysis of the purchase of a $250,000 annuity, paying a flat 4 percent a year, by a 65-year-old male. The last two columns of the chart show the results of a present value analysis of the annuity in question, one based on present value alone, the other based on present value with probability of receipt of payment factored in. The probability numbers are calculated from annual mortality tables. Note: The mortality numbers/factors shown are from a 2014 case and do not reflect the current mortality factor numbers.

The numbers in the last two columns break down the numbers at the 10, 20, and 30 year marks, with a final analysis if the annuitant were to reach age 100. Given the prospective annuity owner’s current life expectancy at age 65, approximately 17 years, the numbers speak for themselves. Explains why annuity issuers pay such high commissions for annuity sales. I would also submit that the numbers clearly establish the strength of a potential fiduciary breach claim against a plan sponsor for both prudence and loyalty, due to the lack of a commensurate return, resulting in a significant windfall in favor of the annuity issuer at the plan participant’s expense.

Annuity advocates often counter that annuity owners do care about present value calculations as long as they receive “guaranteed income for life.” Based on my personal experience, once annuity owners are provided with the relevant information and realize the true situation, they care deeply.

Annuity owners often realize that they cannot make ends meet with the income produced by an annuity alone. When I explain that they can sell their annuity, but that the price they will receive will be a deeply discounted number based on the annuity’s present value, they do care.

Going Forward

When I hear people talking about purchasing an annuity, whether it be a qualified annuity, an annuity purchased within a pension plan, or a non-qualified annuity, an annuity purchased outside a pension plan, I just wish I could perform a forensic analysis for them using Lesti’s methodology so they would have “sufficient information to make an informed decision,” the same standard required of plan sponsors seeking the safe harbor protection of ERISA Section 404(c). Plan sponsors considering offering annuity options within their plan must determine how, and if, they are going to provide such valuable information to each plan participant in order to meet the “sufficient information” requirement of section 404(c), or simply forego the potential protection offered by the section.

In my 42 years of practicing law, I have rarely seen an analysis of a life annuity that factors in both present value and the mortality/probability of receiving payments issues. The chart shown explains why prospective annuity customers are not provided with such an analysis.

The chart also supports one commentator’s suggestion that such present value calculations and charts “suggest that those providing annuities understand present value calculations, while those who are forced to purchase their products do not.”7 This lack of transparency allows the annuity industry to continue to recommend inequitable annuities and potentially expose plan sponsors and other investment fiduciaries to unnecessary fiduciary liability.

Both SECURE and SECURE 2.0 were intended to provide potential safe harbors for plan sponsors that choose to include annuities within their plans. Plan sponsors should note that those potential safe harbors apply to liability under ERISA. It appears that plan participants would still be able to sue plan sponsors under such common law causes of action such as negligence and fraud for inclusion of annuties, in any form, within a plan

Chris Tobe has discussed a number of the inherent issues connected with annuities, such as single entity credit risk, illiquidity, and excessives costs, on our “The CommonSense 401(k) Project) web site, Given the evidence provided by the chart herein and other such inherent issues with annuities, one can only wonder why plan sponsors would unnecessarily expose themselves to potential fiduciary liability by even considering including annuities in their plans. I guess it proves the truth of the saying, “common sense ain’t so common.”

ERISA does not require that plans offer any specific type of investment, including annuities. ERISA only requires that each investment option within a plan be legally prudent. So, again, why would plan sponsors even consider including annuities within their plan? Annuity advocates and plan sponsors argue that plan participants want choice, guaranteed income, and peace of mind in retirement. My response is that plan participants who still want to purchase annuities after being presented with all the relevant facts could still do sooutside the plan, without exposiing the plan and plan sponsors to an risk of fiduciary liability.

Just as I have consistently argued that cost-inefficient actively managed mutual funds do not constitute a legitimate “choice,” forensic analyses of annuities factoring in both present value and mortality issues clearly establish the legal imprudence of annuities. Proof of this can be provided by simply insisting that the annuity salesperson provide you with a forensic analysis chart that factors in both present value and mortality/probability of payment issues.

Both the legal and annuity industries are still awaiting decisions in both the Matney8 and Home Depot9 401(k) litigation cases. The key issue in both cases is who has the burden of proof on the issue of causation of harm. A number of federal courts, the Solicitor General of the United States, and the Department of Labor have already opined that once the plan participants establish a fiduciary breach and a resulting loss, the plan sponsor has the burden of proving that their actions did not cause such losses. As these parties have pointed out, this is the only equitable result since only the plan sponsor knows why they made the decisions that resulted in a berach of their fiduciary duties.

I am on record as saying that I believe that the Matney and Home Depot decisions will ultimately result in increased 401(k) and 403(b) litigation, both between plans/plan participants and plans/plans advisers. I believe that the combination of the Active Management Value Ratio metric and forensic analyses of annuities using Lesti’s methodology will help plan participants carry their burden of proof, while making it very difficult for plan sponsors to carry their burden of proof.

The next 12 to 18 months promise to be very interesting, and telling, for 401(k) and 403(b) plan sponsors.

Notes

1. Meinhard v. Salmon, 249 N.Y. 458, 464 (1928).

2. Jeremy Babener, “Justifying the Structured Settlement Tax Subsidy: The Use of Lump Sum Settlement Monies,” NYU Journal of Law & Business (Fall 2009)

3. Paul J. Lesti, “Structured Settlements,” (Bancroft-Whitney Co.: 1986). (Lesti)

4. Lesti, 114.

5. Lesti, 114.

6. Lesti, 114.

7. Guy Fraser-Sampson, “No Fear Finance: An Introduction to Finance and Investment for the Non-Finance Professional,” (Kogan Page: 2011)

8. Matney v. Briggs Gold of North America, Case No. 2:20-cv-275-TC (C.D. Utah 2022).

9. Pizarro v. Home Depot, Inc., No. 22-13643 (11th Cir. 2022), 24.

Copyright InvestSense, LLC 2023. All rights reserved.

This article is for informational purposes only, and is neither designed nor intended to provide legal, investment, or other professional advice since such advice always requires consideration of individual circumstances. If legal, investment, or other professional assistance is needed, the services of an attorney or other professional advisor should be sought.

You must be logged in to post a comment.