By James W. Watkins, III, J.D., CFP Board Emeritus™, AWMA®

My decision to transition into fiduciary risk management was based largely on my love of the law and psychology. My minor in college was psychology, with a focus on cognitive behavior and decision-making.

The idea of combining behavioral psychology with fiduciary law came about largely as a result of Annie Duke’s excellent book, “Thinking in Bets.”1 While many know Dukes from her days a poker champion, she has a doctorate in behavioral psychology and provides seminars and consulting services on the topic of decision-making.

I am admittedly a psychology “geek.” That said, I could not put Duke’s book down due to the way she effectively combines technical psychology concepts with simple common sense. My immediate thought was that this is something that plan sponsors and other investment fiduciaries should consider to reduce their potential liability exposure and improve their overall effectiveness.

Duke’s basic argument is that far too often society incorrectly evaluates the quality of a decision based on the ultimate results rather than on the quality of the decision-making process that was used in making the decision. This focus on quality of process instead of results is the same standard that is used in ERISA litigation.

Based on my experience from working with investment fiduciaries, this is often the biggest bet, aka mistake, investment fiduciaries make, whether they realize it or not. Far too often product salespeople play “head games,” putting ideas in the heads of fiduciaries as part of a sales spiel, ideas that are often inconsistent with a plan sponsor’s duties and obligations under ERISA, thereby increasing a plan sponsor’s potential liability exposure.

One of the biggest challenges I face with new clients is de-programming them from such marketing spiels and bringing their actions in line with ERISA’s standards. Fortunately, developing an ERISA-compliant decision-making process is relatively simple once the fiduciary understands the importance of “controlling the controllables” as part of a prudent fiduciary process.

As Duke points out, evaluating decisions based purely on results is flawed in that often results are influenced by factors which are beyond anyone’s control. Fiduciaries should be evaluated on their ability to control the controllable.

THE Question

I recently read an article on the annuity industry’s plans for marketing annuities and other “guaranteed income” products to 401(k) plans. In a ranking of the most common reasons why plan sponsors said they might consider adding ”guaranteed income” products and strategies, the number one response was that employers felt an obligation to provide employees with a means of generating additional income.

That is why the first question I always ask a potential fiduciary client is “what do you believe your fiduciary responsibilities require you to do?” The answers typically involve ensuring “retirement readiness” and/or ensuring a certain level of return. When I explain the importance of process over return in terms of ERISA compliance and potential liability exposure, my job becomes that much easier.

I go over the actual language of ERISA Section 404(a)2 and 404(c)3 and explain how to effectively address the potential compliance/liability issues under both sections. Nowhere in either section does ERISA require a plan sponsor to include annuities, actively managed mutual funds, or any other specific type of investment product or strategy.

Other than section 404(c)’s requirement that a plan offer a minimum of three broadly diversified investment options, neither section requires a plan to offer a minimum number of investment options. After SCOTUS’s Hughes decision4, a valid argument can be made that less is more, that each additional investment option offered within a plan potentially raises the likelihood of a fiduciary breach due to the inclusion of an imprudent investment option. And yet, we continue to see plans offering 15-20, or more, investment options, many of which are cost-inefficient and, thus, imprudent

As the annuity industry tries to convince more plans to include annuities and other guaranteed income products into their plans, I point out that Section 404(a) includes language requiring a plan to always act in the best interest of both the plan participant and their beneficiaries. (emphasis added)

I am still waiting for someone to truthfully explain to me how a product is in the best interests of a plan participant and their beneficiaries when that product requires the annuity owner to

- surrender ownership of the annuity contract and the accumulated value to the annuity issuer in order to receive the contractual alleged, with no guarantee of the investor receiving a commensurate return,

- incur excessive, and often counterintuitive, fees, potentially reducing an investor’s end-return by one-third or more, and

- forego any estate plans of providing any remainder interests for one’s heirs.

I have previously stated my position with regard to annuities in ERISA plans:

To the extent that an annuity requires the annuity owner to surrender ownership of the annuity contract and conrol of the accumulated value of the annuity to receive the alleged benefit promised by the annuity, with no guarantee of the annuity owner even breaking even/receiving a commensurate return, and the terms of the annuity contract written in such a way as to essentially ensure that the annuity issuer and/or other third parties will reap a windfall at the annuity owners expense, such an annuity is a breach of an investment fiduciary’s duties of loyalty and prudence.

Betting on Actively Managed Mutual Funds

Most 401(k) and 403(b) plans are still dominated by actively managed funds. Studies have consistently shown that the overwhelmingl majority of actively managed funds are imprident under fiducairy law since they are cost-inefficient, with some not being able to even cover their costs.

- 99% of actively managed funds do not beat their index fund alternatives over the long term net of fees.5

- Increasing numbers of clients will realize that in toe-to-toe competition versus near–equal competitors, most active managers will not and cannot recover the costs and fees they charge.6

- [T]here is strong evidence that the vast majority of active managers are unable to produce excess returns that cover their costs.7

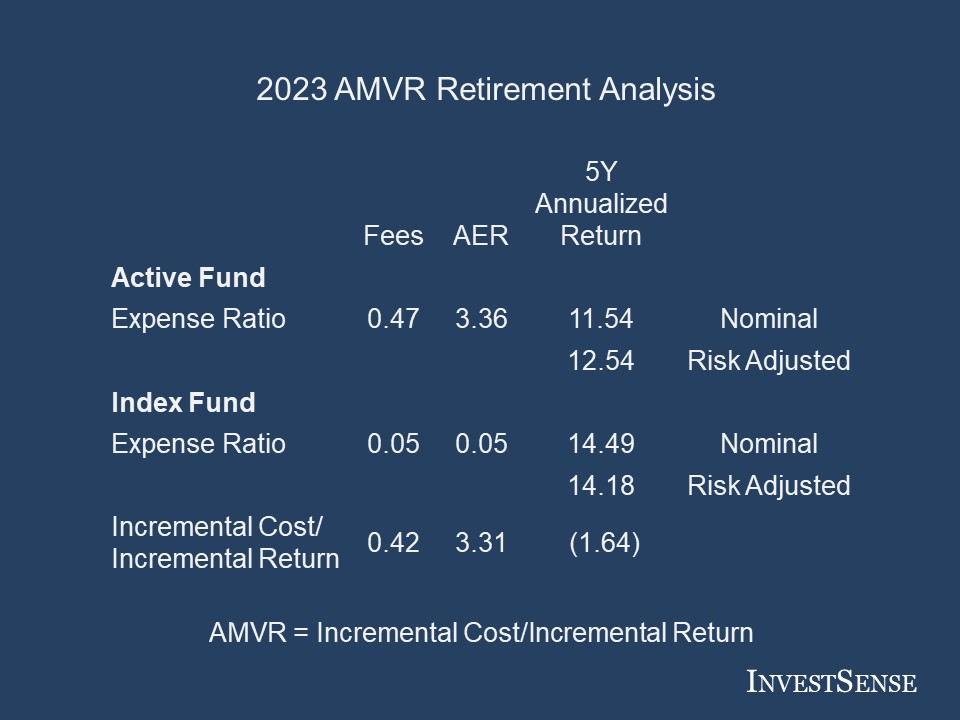

I teach my clients how to use a metric that I created, the Active Management Value RatioTM (AMVR). The AMVR allows investment fiduciaries, attorneys, and investors to quickly calculate the cost-efficiency of an actively managed mutual fund realtive to a comparable index fund. The AMVR is based on the research of investment icons, including Nobel laureate Dr. William F. Sharpe, Charles D. Ellis, and Burton L. Malkiel.

The best way to measure a manager’s performance is to compare his or her return with that of a comparable passive alternative.8

So, the incremental fees for an actively managed mutual fund realtive to its incremental returns should always be compared to the fees for a comparable index fund relative to its returns. When you do this, you’ll quickly see that the incremental fees for active management are really, really high – on average, over 100% of incremental returns.9

Past performance is not helpful in predicting future returns. The two variables that do the best job in predicting future performance [of mutual funds] are expense ratios and turnover.10

A sample AMVR analysis is shown below. The beauty of the AMVR is its simplicity. In interpreting a fund’s AMVR scores, an attorney, fiduciary or investor must only answer two simple questions:

- Does the actively managed mutual fund produce a positive incremental return?

- If so, does the fund’s incremental return exceed its incremental cost?

If the answer to either of these questions is “no,” then the fund does not qualify as cost-efficient under the Restatement’s guidelines.

The AMVR slide shown above is a cost/benefit analysis comparing the retirement shares of two popular large cap growth mutual funds, one an actively managed fund, the other an index fund.

The AMVR slide shows that the actively managed fund’s incremental costs (42 basis points) exceed the fund’s incremental returns, which are negative. Therefore, an investor in the actively managed fund paid a fee and received absolutely no corresponding benefit. (A basis point equals 1/100th of one percent.} Since costs exceed returns, this results in the actively managed fund being cost-inefficient relative to the index fund for the time period studied. If we analyze the incremental costs of the actively managed fund using Miller’s Active Expense Ratio, which factors in the correlation between two funds. the cost-inefficiency increases over 700 percent (42 basis points to 331 basis points)

It is important that investment fiduciaries remember that both returns and costs compound over time. The Securities and Exchange Commission and the General Accountability Office have both found that each additional 1 percent in costs/fees reduces an investor’s end-return by approximately 17 percent over a twenty year period.11

Using the nominal/publicly stated data, if we treat the incremental underperformance of the actively managed fund as an opportunity cost, and combine that number with the incremental costs, based on the fund’s stated expense ratio, the projected loss in end-return would be approximately 35 percent, 2.06 basis points times 17.

But does the nominal/stated cost version of the AMVR actually reflect the costs incurred by plan participants if the actively managed fund is selected within a plan?

The Active Expense RatioTM

There are somepeople, myself included, that feel that an actively managed fund’s stated expense ratio does not accurately reflect the implicit cost of an actively managed costs. Fortunately, Ross Miller introduced a metric, the Active Expense Ratio (AER), which allows fiduciaries and investors to calculate both the amount of acrtive management provided by an actively managed fund and the implicit costs of such active management. Miller explains the importance of the AER as follows:

“Mutual funds appear to provide investment services for relatively low fees because they bundle passive and active funds management together in a way that understates the true cost of active management. In particular, funds engaging in ‘closet’ or ‘shadow’ indexing charge their investors for active management while providing them with little more than an indexed investment. Even the average mutual fund, which ostensibly provides only active management, will have over 90% of the variance in its returns explained by its benchmark indexs.”12

In the AMVR example shown, using nothing more than just the actively managed fund’s r-squared/correlation of returns number and its incremental cost, the AER estimates the actively managed fund’s implicit expense ratio to be 3.36, resulting in incremental correlation-adjusted expense ratio/costs of 3.31. Combined with the actively managed fund’s underperformance, and using the DOL’s and GAO’s findings, that would result in a projected loss in end-return of approximately 84 percent over a twenty year period.

So, combining behavioral psychology and the law of fiduciary prudence, which is the better bet for a plan, the actively managed fund or the comparable index fund?

Betting on Annuities

In my first draft of this post, I had prepared a detailed analysis of both the various types of annuities and the inherent potential fiduciary liability issues. A colleague reminded me that I had already done numerous posts addressing such issues on my blogs, such as here, here, and here. My colleague suggested that I keep this post simple by using my standard response to advocates for annuities in pension plans – ERISA does not require that a plan sponsor offer an annuity, in any form, within an ERISA plan.

I often get calls and emails from clients and non-clients telling me that the plan adviser or a sales consultant has shown them articles or sales literature indicating that plan participants want some type of product that guarantees them income, preferably for life. As I recently posted, my response is, and always will be the following:

“A plan sponsor’s fiduciary reality is defined by ERISA and the Restatement of Trusts, not by what plan participants allegedly want or what plan advisersand/or consultants may recommend.

I also share my legal experiences with the annuity industry with regard to their polls and research. When legal actions involve potentially large damage awards, the insurance company usually requests that the court require that the injured plaintiff accept an annuity as a large part of the terms of any settlement The annuity industry based such demand on alleged research that showed that over 90 percent of plaintiffs quickly dissipated settlement funds.

The annuity industry engaged in this type of intentional misrepresentation in legal actions for years. Finally, when pressured about the source of their alleged research, the annuity industry admitted there was no such reseach, that the annuity industry had simply made it up.13 This is why plan sponsors and other investment fiduciaries should always consider the source when the annuity industry, or any other industry, announces self-serving results from alleged studies and polls.

As I tell my fiduciary clients, if annuities is the answer, you are asking the wrong question. Or, as one of my financial planning colleagues says, “annuities are always your fifth best option.”

Once again, plan sponsors have no legal, moral, or any other type of obligation to offer annuities, in any form, within an ERISA plan. Plan participants interested in annuities are free to purchase one outside of the plan, without subjecting the plan sponsor to potential liability.

Going Forward

At the beginning of this post, I stated that the biggest bet that plan sponsors and other investment fiduciaries often make is not knowing and understandoing what their fiduciary duties do and do not require them to do. Hopefully, the examples provided herein have convinced plan sponsors of the value of objectively researching all investments being considered by their plan.

The idea of thinking in bets in connection with fiduciary prudence goes beyond just evaluating potential investment option within a plan. I advise my plan sponsor clients to use three simple questions, my proprietary “Why Go There” tool, in connection with any fiduciary decision:

- Does ERISA explicitly require a plan sponsor to take or not to take the action?

- Would or could the action result in potential liability exposure?

- If the action is required by ERISA, is there a more effective option that would/could reduce any potential liability exposure?

I continue to see plan sponsors who agree to advisory contracts that include a fiduciary disclaimer clause. A fiduciary disclaimer clause is a provision that provides that the plan adviser assumes no fiduciary responsibility and/or liability in connection with any and all services and recommendations that the plan adviser provides to the plan. There are ERISA attorneys, myself included, that argue that a plan sponsor who agrees to the inclusion of a fiduciary disclaimer clause in the plan’s advisory contract has breached their fiduciary duties of loyalty and prudence.

My position is that a fiduciary disclaimer clause is essentiually an admission that the plan adviser has no confidence in its intended advice and/or product recommendations. Otherwise, why insert such a clause that protects the best interest of the plan adviser at the cost of the plan sponsor and the plan participants? If the plan advisor has no faith in their own products and recommendations, why should the plan sponsor have any faith in the plan advisor. Common Sense alone should tell you that plan advisers who insist on fiduciary disclaimer clauses are a bad bet.

As I mentioned ealier, I advise my clients to always require a plan adviser and any consultants to (1) agree, in writing, that they will be serving in a fiduciary capacity, with all relative duties and obligations, and (2) that they will provide written documentation providing a breakeven analysis on all products and/or strategies recommended to the plan, including an AMVR analysis on all actively managed mutual funds, using the AMVR format provided herein, with no alleged “improvements.” Be sure that your contract has language providing any and all such breakeven analyses are automatically incorporated into the original advisory contract or, in the alternative, that the original advisory contract is amended to add such a provision.

Fair warning, my experience has been that most plan advisers and consultants refuse to provide such documentation since they know the true quality of the advice they are providing and the potential liability involved. At the same time, I think TIAA-CREF summed up a plan sponsor’s legal obligations in selecting and monitoring plan advisory personnel perfectly when it stated that a plan sponsor has an obligation to look beyond prices and objectively and accurately determine the value being provided to a plan by such parties.14

NOTES

1. Annie Duke, “Thinking in Bets: Making Smarter Decisions When You Don’t Have All the Facts,” (Penguin Books: 2019)

2. 29 C.F.R. § 2550.404(a); 29 U.S.C. § 1104(a).

3. 29 C.F.R. § 2550.404(c); 29 U.S.C. § 1104(c).

4. Hughes v. Northwestern University., 142 S. Ct. 737, 211 L. Ed. 2d 558 (2022)

5. Laurent Barras, Olivier Scaillet and Russ Wermers, False Discoveries in Mutual Fund Performance: Measuring Luck in Estimated Alphas, 65 J. FINANCE 179, 181 (2010).

6. Charles D. Ellis, The Death of Active Investing, Financial Times,January 20, 2017, available online at https://www.ft.com/content/6b2d5490-d9bb-11e6-944b-eb37a6aa8e.

7. Philip Meyer-Braun, Mutual Fund Performance Through a Five-Factor Lens, Dimensional Fund Advisors, L.P., August 2016.

8. William F. Sharpe, “The Arithmetic of Active Investing,” available online at https://web.stanford.edu/~wfsharpe/art/active/active.htm.

9. Charles D. Ellis, “Letter to the Grandkids: 12 Essential Investing Guidelines,” https://www.forbes.com/sites/investor/2014/03/13/letter-to-the-grandkids-12-essential-investing-guidelines/#cd420613736c

10. Burton G. Malkiel, “A Random Walk Down Wall Street,” 11th Ed., (W.W. Norton & Co., 2016), 460.

11. Pension and Welfare Benefits Administration, “Study of 401(k) Plan Fees and Expenses,” (DOL Study) http://www.DepartmentofLabor.gov/ebsa/pdf; “Private Pensions: Changes needed to Provide 401(k) Plan Participants and the Department of Labor Better Information on Fees,” (GAO Study).

12. Ross Miller, “Evaluating the True Cost of Active Management by Mutual Funds,” Journal of Investment Management, Vol. 5, No. 1, 29-49 (2007) https://papers.ssrn.com/sol3/papers.cfm?abstract_id=746926.

13. Jeremy Babener, “Structured Settlements and Single-Claimant Qualified Settlement Funds: Regfulating in Accordance With Structured Settlement History,” New York University Journal of Legislation and Public Policy, Vol . 13, 1 (March 2010)

14. https://www.tiaa.org/public/pdf/performance/ReasonablenessoffeesWP_Final.pdf.

Copyright InvestSense, LLC 2024. All rights reserved.

This article is for informational purposes only, and is neither designed nor intended to provide legal, investment, or other professional advice since such advice always requires consideration of individual circumstances. If legal, investment, or other professional assistance is needed, the services of an attorney or other professional advisor should be sought

You must be logged in to post a comment.