By James W. Watkins, III, J.D., CFP Board Emeritus™, AWMA®

An analysis of the 2Q “cheat sheets” can be summed up quite simply – “the song remains the same.” None of the six funds qualified for an AMVR score based on either the 5 or 10-year analysis, meaning that the funds proved to be cost-inefficient, and thus legally imprudent, under the standards established by the Restatement (Third) of Trusts (Restatement). Readers are reminded that InvestSense bases its AMVR analysis of actively managed funds on incremental risk-adjusted returns and incremental correlation-adjusted costs, as explained later herein

For new followers, the “cheat sheets” provide a 5 and 10-year cost-efficiency analysis of the non-index funds in the ten most commonly used funds in U.S. defined contribution plans, based on “Pensions & Investments” annual poll. But this trend has even more relevance given the amicus brief that the Department of Labor (DOL) filed in the Home Depot 401(k) case currently pending in the 11th Circuit Court of Appeals. As the DOL pointed out in the amicus brief, the message within the brief was intended for the 10th Circuit as well, as they consider the same question in the Matney case.

First, a few of the pertinent quotes from the amicus brief.

ERISA is silent on who bears the burden of proving loss causation in fiduciary breach cases.1

As the Supreme Court and this Court have recognized, where ERISA is silent, principles of trust law—from which ERISA is derived—should guide the development of federal common law under ERISA. Trust law provides that once a beneficiary establishes a fiduciary breach and a related loss, the burden on causation shifts to the fiduciary to show that the loss was not caused by the breach.2

This burden-shifting framework reflects the trust law principle that “as between innocent beneficiaries and a defaulting fiduciary, the latter should bear the risk of uncertainty as to the consequences of its breach of duty.”3

Trust law requires breaching fiduciaries to bear the risk of proving loss causation because fiduciaries 14 often possess superior knowledge to plan participants and beneficiaries as to how their plans are run. (citing Restatement (Third) of Trusts § 100 cmt. f)4

In short, [a plan sponsor] has to prove “that a prudent fiduciary would have made the same decision.”5 (emphasis added)

At this point, the DOL made an interesting observation, citing the Second Circuit’s Sacerdote v. New York University decision, in particular the Court’s observation that

If a plaintiff succeeds in showing that “no prudent fiduciary” would have taken the challenged action, they have conclusively established loss causation, and there is no burden left to “shift” to the fiduciary defendant.6

Proving Fiduciary Breach and Loss

The DOL’s amicus brief relied heavily on the common law of trusts. This is appropriate given the fact that the courts have consistently noted that ERISA is essentially the codification of the common law of trusts. The Restatement is just that, a restatement of the common law of trusts, which is why SCOTUS recognized the Restatement as a valid resource in resolving fiduciary disputes.

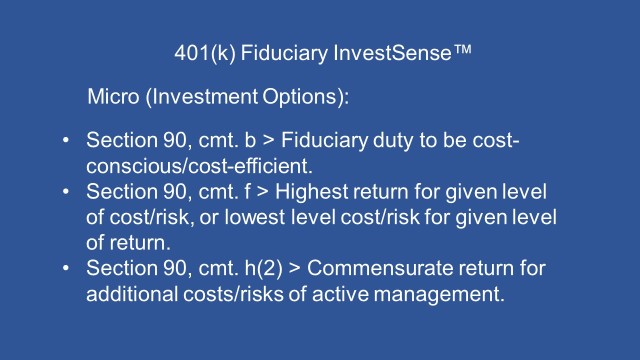

Two dominant themes throughout ERISA are cost-consciousness/cost-efficiency and diversification. In my role as a fiduciary risk management counsel, I focus on three key Restatement provisions addressing cost-consciousness:

So, with these three principles in mind, how do plaintiffs establish both the plan sponsor’s breach of their fiduciary duties and the resulting loss?

Actively managed mutual funds still dominate most 401(k) and 403(b) plans. A couple of years ago, I created a simple metric, the Active Management Value RatioTM (AMVR). The AMVR allows plans sponsors and other fiduciaries, as well as investors and attorneys, to quickly and easily assess the prudence of an actively managed funds against a comparable index fund.

One of the most common actively managed funds in 401(k) and 403(b) plans is Fidelity’s Contrafund Fund, K shares (FCNKX). A five-year and a ten-year AMVR analysis of FCNKX is shown below.

An actively managed fund’s AMVR score is calculated by dividing the fund’s incremental correlation-adjusted costs by its incremental risk-adjusted return. The costs and return calculations are based on comparisons to a comparable index fund.

The AMVR slides shown above also show how the prudence/imprudence of an actively managed fund can quickly be determined by just answering two questions:

(1) Does the actively managed mutual fund provide a positive incremental return relative to the benchmark being used?

(2) If so, does the actively managed fund’s positive incremental return exceed the fund’s incremental costs relative to the benchmark?

If the answer to either of these questions is “no,” the actively managed fund is both cost-inefficient and imprudent according to the Restatement’s prudence standards and should be avoided. The goal for an actively managed fund is an AMVR number greater than “0” (indicating that the fund did provide a positive incremental return), but equal or less than “1” (indicating that the fund’s incremental costs did not exceed the fund’s incremental return).

Assuming that the burden of proof on causation is shifted to the plan sponsor, what is the likelihood that the plan sponsor could successfully carry such burden, could prove “that a prudent fiduciary would have made the same decision?”7

In the five-year analysis, FCNKX failed to even produce a positive incremental risk-adjusted return. Strike One.

If you treat the underperformance (-1.45) as an opportunity cost and combine it with the incremental nominal cost (0.42), the projected loss in end-return over a twenty-year period would be approximately 32 percent. The projected loss would be even greater, approximately 81 percent, if a more realistic cost analysis was conducted using the Active Expense Ratio. Strike Two.

One often overlooked benefit of the AMVR is that it indicates the premium that a cost-inefficient investment extracts from an investor. In this case, the AMVR indicates that an investor would be paying a premium of 331 basis points…while receiving nothing in return. Strike Three.

In the ten-year analysis, FCNKX did provide a slight positive incremental return (0.31). However, the fund was still cost-inefficient, as it did not manage to cover the fund’s incremental costs (0.42), resulting in a net loss for an investor. As the comment to Section Seven of the Uniform Prudent Investors Act states, “wasting beneficiaries, money is imprudent.”8

The 10-year AMVR analysis of FCNKX provides further evidence of why fiduciaries should always calculate a fund’s incremental costs using Miller’s Active Expense Ratio, as it factors in the correlation of returns between two investments to provide a more realistic evaluation of an investment’s value-added benefit, or lack thereof. In this case, the AER calculates that FCNKX is providing approximately 12.50 percent of active management. Factoring in the implicit AER expense ratio (3.36) would result in an investor suffering a projected loss of approximately 56 percent in their end-return over a twenty-year period.

In this case, since the fund did produce a positive risk-adjusted return, we can calculate an AMVR score using the Vanguard Large Cap Growth Index fund as a benchmark. FCNKX’s high r-squared/correlation of return (98) results in an AMVR score of (10.67) (3.31/0.31), indicating that an investor would be paying a premium of over 900 percent ((10.67-1) x 100).

It is hard to see how a plan sponsor, if confronted with such evidence, could carry the burden of proving that their choice of FCNKX as a plan investment was not imprudent. In fact, as pointed out earlier, the Second Circuit Court of Appeals has suggested as much.

The Active Expense Ratio

People frequently ask me why I use the Active Expense Ratio in the AMVR. Their question basically asks why plan sponsors, trustees, RIAs and other fiduciaries never mention the AER if it is so meaingful and important.

The answer is simply that the combination of the AMVR and the AER provide a level of analysis that frequently exposes the imprudence of a recommended investment in comparison to other available alternatives. Transparency is the financial and insurance industries’ kryptonite. Prove it to yourself by asking them to provide you with an AMVR exactly as shown herein.

I had one follower do just that. He reported that the plan adviser came back with a modified version of the AMVR which he claimed were “improvements.” The follower spotted the attempt to conceal the imprudence of the adviser’s recommendations. A framed copy of the follower’s polite note sits proudly on my desk.

Ross Miller, the creator of the Active Expense Ratio metric, summed up the value of the AER as follows:

Mutual funds appear to provide investment services for relatively low fees because they bundle passive and active funds management together in a way that understates the true cost of active management. In particular, funds engaging in ‘closet’ or ‘shadow’ indexing charge their investors for active management while providing them with little more than an indexed investment. Even the average mutual fund, which ostensibly provides only active management, will have over 90% of the variance in its returns explained by its benchmark index.9

By separating the relative costs of passive management and investment management, then calculating the amount of active management contributed by the actively managed fund, a fiduciary can derive the implicit cost of the active management provided by the actively managed fund. The higher an actively managed fund’s r-squared/correlation of returns to a comparable index fund and/or the higher the active fund’s incremental cost relative to the comparable index fund, the higher the actively managed fund’s AMVR score, cost-inefficiency, and legal imprudence. This is just the type of transparency the investment and insurance industries try to avoid, as they consistently oppose any type of true fiduciary standard requiring full and honest disclosure in making investment recommendations.

Going Forward

Being a pack rat has its benefits. In researching my files for this post, I ran across this valuable reminder from a TIAA-CREF publication entitled “Assessing Reasonableness of 403(b) Retirement Plan Fees”:

Plan sponsors are required to look beyond fees and determine whether the plan is receiving value for the fees paid.

Based on my experience, the AMVR suggests that the overwhelming majority of 401(k) and 403(b) plans and plan participants are not receiving value when compared to available investment alternatives, true alternatives under an open architecture platform. Plan sponsors can, and should, perform an objective fiduciary prudence audit using both the AMVR and the AER.

This is especially true since there are currently two cases pending in the federal appellate court that essentially address the

Whether, in an action for fiduciary breach under [ERISA], once the

plaintiff establishes a breach and a related plan loss, the burden

shifts to the fiduciary to prove that the loss is not attributable

to the fiduciary’s breach.10

As the DOL’s amicus brief mentions, the common law of trusts supports the position that the burden of proof on causation properly belongs to the plan sponsor/fiduciary. The majority of the federal Circuit Courts of Appeals agree, as does the Solicitor General of the United States. SCOTUS has already recognized that the Restatement is a respected resource that the courts often look to in resolving fiduciary issues.

Therefore, one can legitimately argue that very soon the courts will be required to shift the burden of proof on causation to plan sponsor once the plan participants establish the breach and resulting loss. The evidence presented herein suggests that that will be a burden many plan sponsors are unable to fulfill.

Enjoy the 4th!

Notes

1. Department of Labor amicus brief in Pizarro v. Home Depot, Inc., No. 22-13643 (11th Cir. 2022) (Amicus Brief), 10. https://www.dol.gov/sites/dolgov/files/SOL/briefs/2023/HomeDepot_2023-02-10.pdf

2. Amicus Brief, 10.

3. Amicus Brief, 13.

4. Amicus Brief, 14.

5. Amicus Brief, 24.

6. Amicus Brief, 26.

7. Amicus Brief, 24.

8. Uniform Prudent Investor Act (UPIA), Section 7 (Introduction).

9. Ross Miller, “Evaluating the True Cost of Active Management by Mutual Funds,” Journal of Investment Management, Vol. 5, No. 1, 29-49 (2007) https://papers.ssrn.com/sol3/papers.cfm?abstract_id=746926.

10. Amicus Brief, 2.

Copyright InvestSense, LLC 2023. All rights reserved.

This article is for informational purposes only, and is neither designed nor intended to provide legal, investment, or other professional advice since such advice always requires consideration of individual circumstances. If legal, investment, or other professional assistance is needed, the services of an attorney or other professional advisor should be sought.

You must be logged in to post a comment.