James W. Watkins, III, J.D., CFP EmeritusTM, AWMA®

From a legal perspective, the lifetime income annuities being pitched for 401(k) and other types of retirement raise legitimate issues re potential fiduciary breach concerns. As a result, the question is why plan sponsors even consider such investments, as there is nothing in ERISA or any other law requiring that a plan offer such investment products within a plan. A recent LIMRA article stated that plan sponsors often state that they feel a need to provide employees with a source for retirement income.

From a purely fiduciary risk management perspective, this argument is legally incorrect. First, there is no requirement that employers address such needs. Employers can best provide for their employees’ retirement needs by ensuring that the investment options within a retirement plan are legally prudent, cost-efficient, and provide employees with the opportunity for a commensurate return on their investment. Employees that desire an annuity can purchase one outside the plan, without exposing the plan sponsor to potential fiduciary liability exposure.

The following article, created by Stanford University’s new AI platform, STORM, addresses a number of legal reasons as to why annuities are the antithesis of fiduciary prudence. One of the best way that both plan sponsors and plan participants can protect themselves from legally imprudent annuities is to insist that the annuity salesperson provide them with a properly prepared breakeven analysis, an analysis that factors in both present value, which considers the time value of money, and mortality risk, the risk that the annuity owner will be alive to receive the guaranteed stream of income.fetime Income

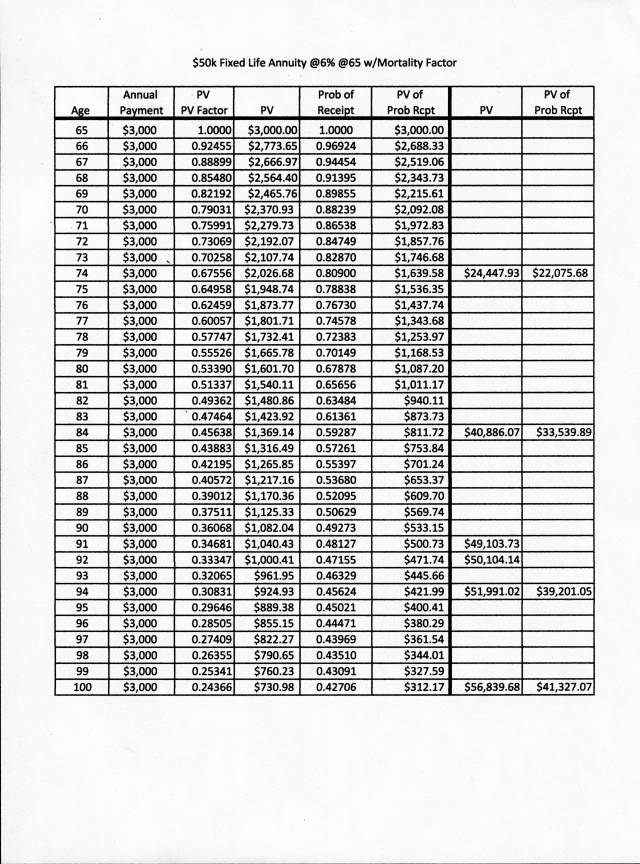

Plaintiff’s attorneys who handle cases involving serious injuries and resulting damages often have to prepare breakeven analyses in order to verify that settlement offers are as represented. Failure to verify such settlement offers can result in legal malpractice actions. Shown below is a sample breakeven analysis on a $50,000, with the annuity owner retiring and annuitizing the annuity at age 65.

This sample analysis shown above is an excellent example of why annuities are the antithesis of fiduciary prudence, and prudent plan sponsors avoid offering guaranteed lifetime income annuities at all. Why go there at all?

Based purely on present value, the analysis projects that the annuity owner would breakeven, i.e., recover their initial investment sometime between age 91 and 92 years of age. At age 65, the annuity owner has an expected life expectancy of 21 years, or age 86. The odds of a 65 year old living to age 91 or 92 is only 30 percent. Keep in mind these numbers do not even include the fact that factoring in mortality risk, even if the annuity owner reaches age 100, the annuity owner will have recovered less than half of their original investment ($41, 320.07).

So, from a fiduciary prudence standpoint, who receives the surplus remaining in the annuity? That depends on the terms of the contract. However, many annuities include a “reverter” clause, often providing that any such surplus reverts back to the annuity issuer. Under equity law, a situation where a third party benefits at the annuity owner’s expense constitutes a “windfall” for the annuity issuer at the annuity owner’s expense. “Equity abhors a windfall.”

Such situations violate a plan sponsor’s fiduciary duty of loyalty, to always act in the best interest of the plan’s participants and their beneficiaries. Therefore, a simple breakeven analysis may actually establish that a plan sponsor “knew or should have known” that the annuity was imprudent from the beginning, resulting in a breach of the plan sponsor’s fiduciary duties of prudence and loyalty.

Another example of annuities being the antithesis of fiduciary involves a plan sponsor’s fiduciary duty of disclosure. Section 404(c) of ERISA requires that a plan sponsor provide plan participants with “sufficient information to make an informed decision. However, the annuity industry is notorious for resisting disclosure and transparency, especially with regard to costs such as “spreads.” Without such material information, there is no way that plan participants can make an informed decision, resulting in yet another fiduciary breach. In fact, a popular form of annuity, indexed annuities, often reserve the right to change material terms of the annuity annually, making it impossible for a plan sponsor to comply with their legal duty to independently investigate and evaluate the prudence of such investments, a fact that federal judge Barbara Lynn noted in connection with the current litigation involving the DOL’s proposed Retirement Security Rule.

Annuities Are the Antithesis of Fiduciary Prudence https://acrobat.adobe.com/id/urn:aaid:sc:VA6C2:59b06a2e-990f-467c-84a8-b6adc49aaffd?viewer%21megaVerb=group-discover

Copyright InvestSense, LLC 2024. All rights reserved.

This article is for informational purposes only, and is neither designed nor intended to provide legal, investment, or other professional advice since such advice always requires consideration of individual circumstances. If legal, investment, or other professional assistance is needed, the services of an attorney or other professional advisor should be sought.

You must be logged in to post a comment.