James W. Watkins, III, J.D., CFP EmeritusTM, AWMA®

I was at a professional reception over the holidays when someone introduced themselves and asked the “what do you do for a living” question. The rest of the conversation went something like this:

“I am a fiduciary risk management counsel.”

“What does a fiduciary risk management counsel do?

“I mainly reverse engineer 401(k) and 403(b) pension plans.”

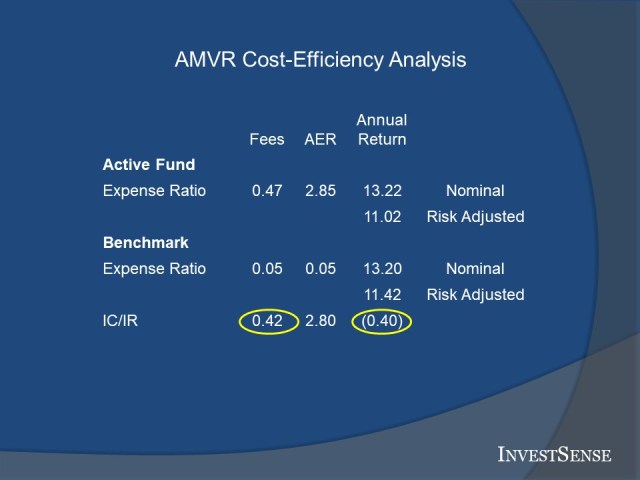

I explained that I basically evaluate pension plans in terms of fiduciary prudence/cost-efficiency using the Active Management Value Ratio (AMVR) metric. He eventually asked me what I thought was the most common mistake plan sponsors make. That’s easy – they expose themselves to unnecessary fiduciary liability exposure because they do not truly understand what is legally required of them.

From there, I basically made my typical marketing pitch. When I asked him what he thought a plan sponsor’s legal duties were, he told me (1) to help plan participants achieve “retirement readiness,” and (2) to offer plan participants as many investment options as possible, to provide them with a “meaningful” choice of investments. And yes, he said “meaningful.”

We ended up talking for a little over thirty minutes and I actually enjoyed it. I always enjoy seeing a plan sponsor actually understand their true legal duties, which allows them to effectively manage their fiduciary risk.

A plan sponsor’s fiduciary duties do not include helping plan participants achieve “retirement readiness,” “financial wellness,” or any of the other marketing buzzwords that plan advisors often use. Why? Simply because, just like a stockbroker or financial adviser, a plan adviser cannot guarantee the performance of any mutual fund or the stock market in advance.

Any liability exposure that stockbrokers, financial advisers, and plan advisers face is due to the quality of their advice at the time that such advice is provided. It’s just that simple. In terms of 401(k) and 403(b) plans, plan sponsors should absolutely be familiar with Sections 404(a) and 404(c) of ERISA, as well as the relevant regulations, The regulations are often overlooked, but they are important as they provide practical advice and information beyond ERISA’s generic framework.

ERISA Section 404(a) states as follows:

(a) Prudent man standard of care

(1)[A] fiduciary shall discharge his duties…

with the care, skill, prudence, and diligence under the circumstances then prevailing that a prudent man acting in a like capacity and familiar with such matters would use in the conduct of an enterprise of a like character and with like aims;…1

Section 404(a) sets out the two themes that run throughout ERISA, the importance of cost-consciousness/cost-efficiency, and diversification, as a means of reducing the inherent risks in the stock market. Notice that Section 404(a) does not require that any specific type of investments be offered as an investment option within a plan. No requirement to offer annuities, target-date funds, or actively managed funds within a plan, even if plan participants request that such investments be offered by a plan.

Many plan sponsors like to qualify for the reduced liability exposure offered by ERISA Section 404(c). However, in order to qualify for such “safe harbor” protection, a plan must satisfy approximately 20 requirements. Experience has shown that very few plans actually satify all of the requirements. As a result, many plan sponsors mistakenly believe they are in compliance with 404(c), when they actually are not.

ERISA Section 404(c) states as follows:

An “ERISA section 404(c) Plan” is an individual account plan described in section 3(34) of the Act that:

(i) Provides an opportunity for a participant or beneficiary to exercise control over assets in his individual account (see paragraph (b)(2) of this section); and

(ii) Provides a participant or beneficiary an opportunity to choose, from a broad range of investment alternatives, the manner in which some or all of the assets in his account are invested (see paragraph (b)(3) of this section).

(2) Opportunity to exercise control.

(i) a plan provides a participant or beneficiary an opportunity to exercise control over assets in his account only if:

(B) The participant or beneficiary is provided or has the opportunity to obtain sufficient information to make informed investment decisions with regard to investment alternatives available under the plan, and incidents of ownership appurtenant to such investments. For purposes of this paragraph, a participant or beneficiary will be considered to have sufficient information if the participant or beneficiary is provided by an identified plan fiduciary (or a person or persons designated by the plan fiduciary to act on his behalf)….2

The InvestSense Fiduciary Risk Management Model

Psychological studies have consistently determined that three points is the maximum number of informational points that most people can retain long-term. I give my fiduciary risk management clients three broad points to remember in managing their practices

- Keep It Simple and Smart, a revised version of the familiar KISS acronym.

- Do not do or offer to do anything beyond what is absolutely legal required.

- Take the time to actually read Sections 401(a) and 401(c) of ERISA, as well as the relevant regulations. Also read Section 90 of the Restatement (Third) of Trusts, which is the most current version of the Restatement. The other alternative is to buy a copy of my book, “The 401(k)/403(b) Investment Manual: What Plan Participants REALLY Need to Know,” which discusses these issues.

Plan advisers, as well as the annuity and actively managed funds advocates, often tell me how bad point #2 is, how plan sponsors should do more, offer more for plan participants to help them achieve “retirement readiness” anad generate “guaranteed retirment income.” I remind them that as a fiduciary risk management counsel, my job is to show my clients how to protect their interest while being ERISA compliant.

Readers of my posts know the approach I teach my clients in evaluating investment products – if ERISA does not specifically require that a specific product be offered within an ERISA plan, then “don’t go there.” Do not waste time arguing with the plan adviser or product salesperson…move on.

Remember, there is often an inherent conflict of interest with a plan adviser’s advice, as they often get compensated, at least in part, on the commissions they can generate from sales to the plans. As one court clearly warned plan spsonsors,

Blind reliance on a broker whose livelihood was derived from the commissions he was able to garner is the antithesis [of a fiduciary’s duty to conduct an] independent investigation”3

“The failure to make an independent investigation and evaluation of a potential plan investment is a breach of fiduciary duty.”4

Point #2 does not tell plan sponsors not to fulfill their legally required fiducairy duties. The suggestion is based on a simple, common sense approach to risk management. Far too many times I have seen a plan sponsor decide to be “nice,” only to see it backfire on them, as plan participants will expect it in the future as well.

Trust me, if the worst case scenario does develop, the plan adviser will probably not be there to support you. That is why so many of the major plan advisers seemingly always include a fiduciary disclaimer clause in their advisory contracts with plans.

In court, I often refer to the inclusion of such clauses in advisory contracts as the plan adviser’s “okey-doke” clause. The urban dictionary defines an “okey-doke” as “some sort of trick, game, scam, attempt to fool, shortchange, deceive or mislead.”5 That is exactly what fiduciary disclaimer clauses do, as they essentially say, “I will provide the plan with all kinds of recommendations, but I am not liable if the advice is legally imprudent at the time I provide it to you.”

Always keep in mind that plan participants always have the right to open a personal investment account outside the plan, with no added liability risk for a plan sponsor. Nothing in ERISA, nor the law in general, requires a plan sponsor to volutarily exposure themselves to unnecessary fiduciary risk exposure.

As for point #3, I emphasize the importance of three Comments to Section 90: Comments b, f, and h(2). While a plan sponsor needs to actually read the Comments in Section 90, the “cheat sheet” shown below indicates just how important cost-efficiency is in determining fiduciary prudence.

In my opinion, Comment h(2) is the Achilles’ heel of most 401(k) and 403(b) plans. Not only do most plan sponsors fail to evaluate their plan’s investment options in terms of commensurate return, most do not even include the commensurate return test as part of their independent investigation and evaluation of the funds included in their plan. An AMVR forensic analysis easily exposes an investment’s failure to provide a commensurate return.

In the sample AMVR analysis shown above, the combination of underperformance and the actively managed fund’s incremental cost would result in an investor suffering an estimated 14 percent reduction in end-return over a twenty year period.6 Perform the same AMVR forensic analysis for each investment option within a plan and the specter of fiduciary liability usually increases. Keep It Simple and Smart.

Fiduciary Duty Short Cuts

Every plan sponsor will swear that they properly performed the required independent investigation and evaluation of each investment option offered within a plan. They will deny that they just relied on whatever the plan adviser or another third-party told them. That’s when a good plaintiff’s attorney will have the plan sponsor methodically go through the process they allegedly used in conducting their investigation and evaluation…only to expose the truth.

A word to the wise. If any ERISA violations are uncovered, do not argue that they were purely unintentional and that no one intended to hurt the plan participants. As courts like to point out in ERISA cases, a pure heart and an empty head are not defense in cases where a breach of one’s fiduciary duties is alleged.7

Going Forward

As I tell my clients, take the time to set the plan up right the first time. A plan sponsor still has to conduct the required review and monitoring on a plan; but if you adopt the InvestSense Fiduciary Prudence Model, a plan sponsor should to be able save a lot of time and money in managing the plan.

The same holds true for existing plans. A full fiduciary prudence audit often helps expose unwanted fiduciary liability issues. Once a plan sponsor properly addresses any compliance and/or liability concerns identified by the audit, the plan sponsor should enjoy the same saving in both cost and time as previously mentioned.

I always remember the CEO at a conference bemoaning the cost incurred in settling a 401(k) action against his firm’s plan. I quickly looked up his firm’s latest Form 5500 and ran an AMVR analysis on the most popular fund in his plan, a well-known actively managed fund. I showed him the results. I conducted a full forensic fiduciary prudence audit the next week and helped his company design a new cost-efficient and ERISA compliant plan.

I love libraries and bookstores. Over the holidays I went into Barnes & Noble to check out Morgan Housel’s excellent new bookm “Same as Ever: A Guide To What Never Changes.” Scanning the “Table of Contents, two chapters in particular immediately drew my atttention – “Trying Too Hard”: There Are No Awarded For Difficulty,” and “Incentives: The Most Powerful Force In The World.”

In the “Incentives” chapter, Housel makes the argument that

when the incentives are crazy, behavior is crazy. People can be led to justify and defend nearly anything.

In the “Trying Too Hard” chapter, Housel revisits the idea that life is actually simple, we just make it difficult. Housel sums the issue up perfectly with a quote from computer scientist Edsger Dijkstra

Simplicity is the hallmark of truth – we should know better, but complexity continues to have a morbid attraction….The sore truth is that complexity sells better.”8

“Simplicity is the hallmark of truth.” Plan sponsors would be wise to consider Rick Ferri’s observation that for plan advisers and other-third parties involved in the pension arena, “complexity is job security.”

Bottom line – Prudent plan sponsors keep it simple. They comply with ERISA without exposing themsleves to unnecessary risks or potential fiduciary liability exposure. And when plan advisers and product salesmen cite self-serving reports of what plan participants supposedly want from their 401(k) and 403(b) plans, the informed and confident plan sponsor can simply respond by pointing out that it does not matter what plan participants think they want or do not want.

The only thing that really matters from a risk management and legal liabilitystandpoint, and that is truly in the plan participants best interest, is that the plan sponsor provide them with prudent investment options that are both cost-efficient, and that allow them to properly diversify their plan investments to hopefully reduce the risk of large investment losses.

It’s just that simple.

Notes

1. 29 U.S.C.A. Section 404a; 29 C.F.R Section 2550.404a-1(a), (b)(i) and (b)(ii).

2. 29 C.F.R. § 2550.404(c); 29 U.S.C. § 1104(c).

3. Liss v. Smith, 991 F. Supp. 278, 299 (S.D.N.Y. 1998).

4. Fink v. National Savs. & Trust Co., 772 F.2d 951, 957, 962 (Scalia dissent) (D.C. Cir. 1985); In re Enron Corp. Securities, Derivatives, and ERISA Litigation, 284 F. Supp. 2d 511, 546 (N.D. Tex 2003): Donovan v. Cunningham, 716 F.2d 1455, 1467 (5th Cir. 1983). (Cunningham)

5. https://urbandictionary.com.

6. Pension and Welfare Benefits Administration, “Study of 401(k) Plan Fees and Expenses,” (DOL Study) http://www.DepartmentofLabor.gov/ebsa/pdf; “Private Pensions: Changes needed to Provide 401(k) Plan Participants and the Department of Labor Better Information on Fees,” (GAO Study).

7. Cunningham, 1467.

8. Morgan Housel, Same as Ever: A Guide To What Never Changes (USA: Penguin, 2023).

Copyright InvestSense, LLC 2024. All rights reserved.

This article is for informational purposes only, and is neither designed nor intended to provide legal, investment, or other professional advice since such advice always requires consideration of individual circumstances. If legal, investment, or other professional assistance is needed, the services of an attorney or other professional advisor should be sought.

You must be logged in to post a comment.