James W. Watkins, III, J.D., CFP EmeritusTM, AWMA®

I often hear or read plan sponsors and other investment fiduciaries describing how hard their jobs are, how difficult it is to select and monitor their plan’s investment options and avoid fiduciary liability risk. After I perform a forensic fiduciary prudence audit, the company’s CEO or other corporate executives will often ask me what they did wrong and how to avoid unnecessary fiduciary liability exposure.

My ususal response is “you listened to the wrong people.” Now before all the plan advisers go ballistic, hear me out. There are experienced and knowledgable plan advisers who can genuinely help plan sponsors. The problem is that plan sponsors often do not know how to evaluate who those quality plan advisers are or how to “separate the wheat from the chaff.”

The other issue that plan sponsors must address is how to determine the quality of the advice that their plan adviser provides. Remember, plan sponsors can seek advice from third parties. However, plan sponsors cannot simply blindly rely on such advice.1 They must conduct their own independent investigation and evaluation of any third party advice.2 Failure to do so, or to do so incorrectly, is a violation of the fiduciary duties required under ERISA.3

In my experience, very few plan advisers provide any sort of fiduciary training to plan sponsors. My experience has generally been that any training provided often creates more questions than answers. I believe there are various reasons for this situation. The bottom line is that plan sponsors are often left with no ideas and no tools on to to conduct their legally required independent investigation and evaluation of potential plan investment options.

When I conduct a forensic fiduciary prudence audit, I conduct a simple fiduciary training sesssion to explain to the plan sponsor how I conduct my audit, explaining how they can use the same techniques in administering their plan. Since psychology shows that most people have both limited attention spans and retention skills, my training sessions typically consist of three common situations that plan sponsors typically encounter.

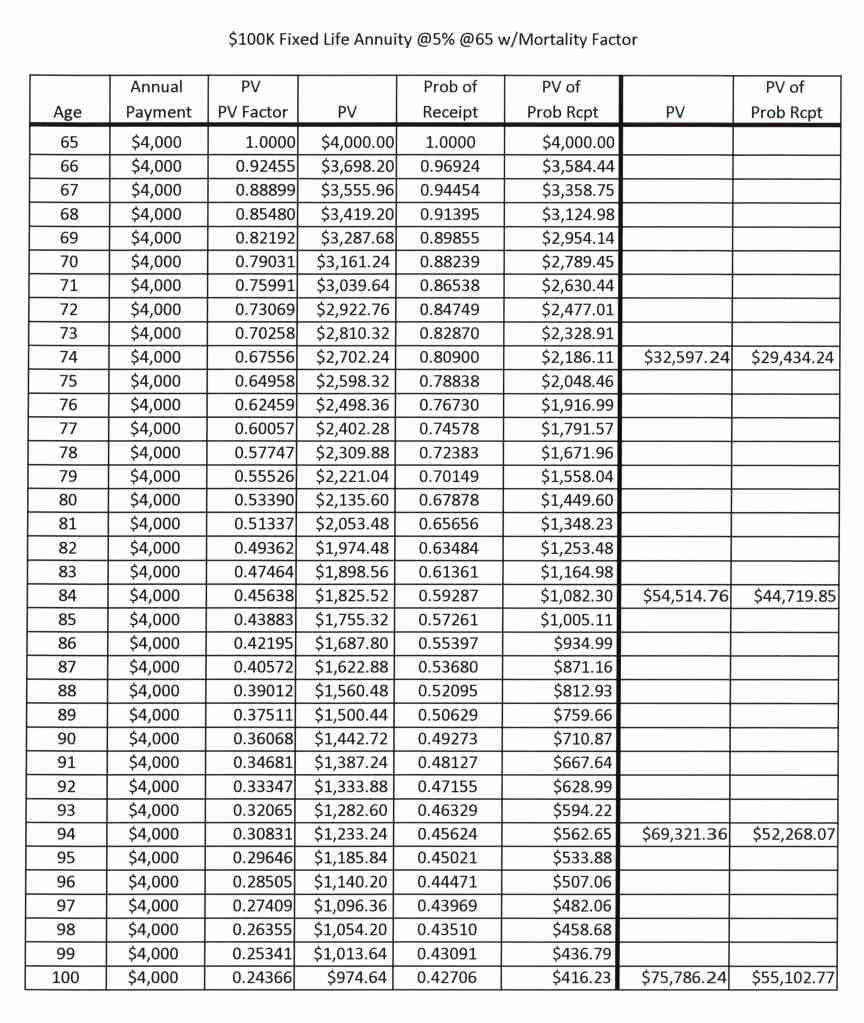

1. Which of the two mutual funds shown in the Active Management Value Ratio (AMVR) slide below is more cost-efficient and, thus, the more prudent investment choice for a fiduciary?

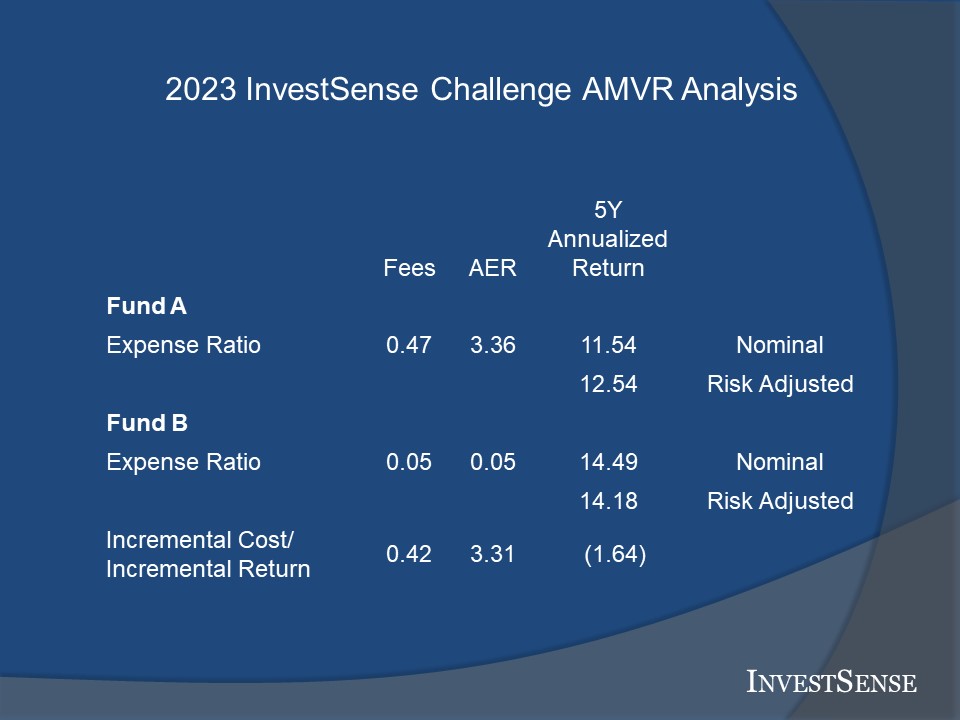

2.Which of the two mutual funds shown in the Active Management Value Ratio slide below is more cost-efficient and, thus, the more prudent investment choice for fiduciaries?

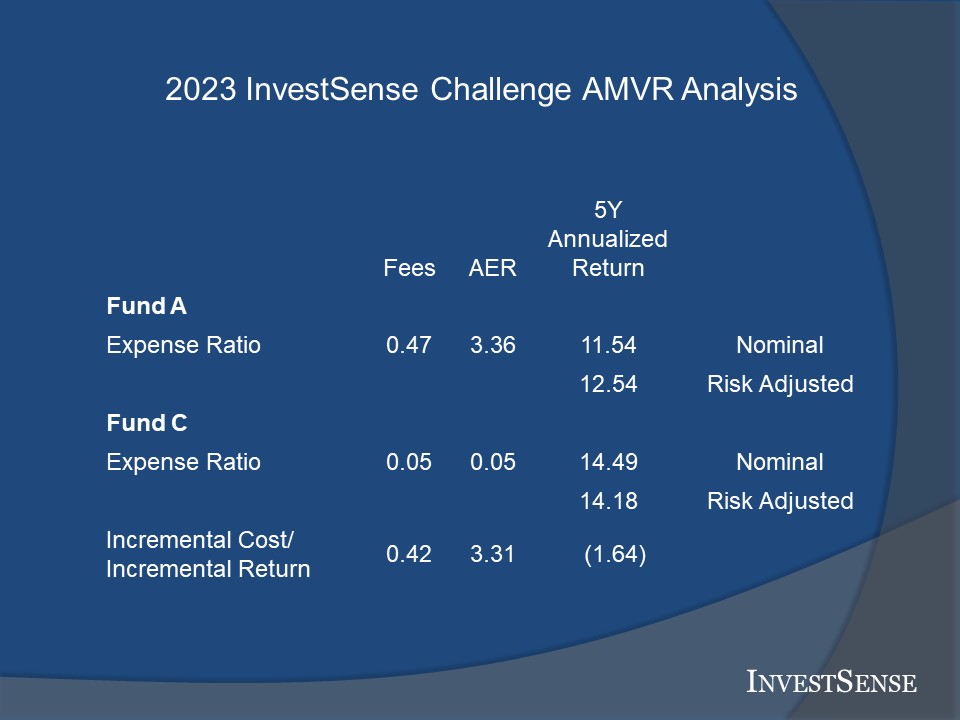

3. At what point would an investor breakeven/receive a commensurate return, i.e., would recover their initial investment, on a $100,000 annuity paying 4 percent annually? Note: This example assumes a “pure insurance” annuity investment.

Answers

1.

Nobel laureate Dr, William F. Sharpe of Stanford University has stated that the best way to evaluate actively managed funds is to compare the actively managed fund to a comparable index fund.4 While seconding Dr. Sharpe’s position, investment icon Charles D. Ellis has gone further, suggesting that the funds should be compared in terms of cost-efficiency by comparing the incremental costs and returns of the actrively managed fund relative to the index fund.5

Fund A, the Fidelity Contrafund Fund, K shares, is one of the most commonly offered mutual funds in U.S. defined contribution plans. The legal question is whether Contrafund’s K shares potentially expose a plan to unnecessary fiduciary liability exposure,

In this esample, Fund B, the Admiral shares of the Vanguard Large Cap Growth Index Fund, outperforms Contrafund’s K shares by 164 basis points (a basis point equals 1/100th of 1 percent, .01). Combined with Contrafund’s higher expense ratio (46 basis points), the cumulative 200 basis points would be projected to reduce a Contrafund’s end-return by 34 percent over a twenty year period.

Some courts take the position that you cannot compare actively managed mutual funds with comparable index funds. Not only is this position contrary to Section 100 of the Restatement (Third) of Trusts, but it is inconsistent with the stated purpose and goal of ERISA, to protect employees and promote cost-conscious saving towards retirement.

People often ask me what the “AER” column represents. “AER” stands for Ross Miller’s metric, the Active Management Value Ratio. Miller explains the value of the metric as follows:

Mutual funds appear to provide investment services for relatively low fees because they bundle passive and active funds management together in a way that understates the true cost of active management. In particular, funds engaging in ‘closet’ or ‘shadow’ indexing charge their investors for active management while providing them with little more than an indexed investment. Even the average mutual fund, which ostensibly provides only active management, will have over 90% of the variance in its returns explained by its benchmark index.6

The AER calculates the implicit cost of any incremental, or additional, costs of an actively managed mutual fund to evaluate the active fund’s relative cost-efficiency, i.e., prudence. In this case, the Contrafund investor would pay an additional 42 basis points without receciving any corresponding benefit. As Section 7 of the Uniform Prudent Investor Act states, wasting beneficiaries’ money is never prudent.7

2.

This slide is included in my fiduciary prudence training session for two reasons. First, to remind plan sponsors of the need to compare all investment recommendations of a fund family with other similar funds within the fund family. In this case, Fidelity has a much more prudent investment option in the same large cap growth category.

Fidelity actually created this LCG fund to compete with Vanguard’s LCG fund. The expense ratio of the Fidelity LCG fund was designed to undercut Vanguard’s low expense ratio. The fund’s performance has also been competitive, in some cases slightly better, than Vanguard’s comparable fund.

Second, the slide illustrates the need for plan sponsors to effectively negotiate for more prudent options within a fund family. When I see Fidelity Contrafund K shares in a plan, I point out the existence of the Fidelity LCG fund. Plan sponsors often note that Fidelity does not offer the LCG fund to 401(k) and 403(b) plans.

However, the key point is that plan sponsors cannot simply settle for a less prudent option when a more prudent option exists within a fund family. Fidelity may be concerned that offering the obviously more prudent LCG fund would result in the cannibalization of the Contrafund K shares. That’s their right and a legitimate concern.

However, in such situations, I believe that a plan sponsor’s fiduciary duties require the plan sponsor to seek alternative investments that comply with their fiduciary duties, whether those alternatives be within the same fund family or another fund family. Bottom line – plan sponsors, and investment fiduciaries in general, cannot “settle” for legally imprudent investments.

In this case, the combined costs, Contrafund’s relative underperformance/opportunity costs (267 basis points), combined with the incremental expense ratio costs (approximately 43 basis points), would project to a 46 percent reduction in an investor’s end-return over a 20-year period (271 basis point times 17).

The simplicity of the AMVR metric has proven to be very well received by both judges and juries. Plan sponsors and other investment fiduciaries who are willing to invest the small amount of time needed to learn the AMVR calculation process will be justly rewarded.

3. In this illustration, the an 65-year-old annuity owner would have to live past age 100 in order to simply break even if the owner chose a single life payout option.

Annuity advocates may object to this “pure insurance” forensic acturial analysis based on the factors of present value and mortality risk. However, the target audience of both this post and this blog is plann sponsors and other investment fiduciaries . The purpose of this particular illustration is to alert plan sponsors of the need to demand information that will alert them to possible issues that they need to consider in performing their legally required independent investigation and evaluation, should they consider offering annuities within their plan in any form, individually or as part of target date funds.

Given the potentially large accounts within 401(k) and 403(b) plans, the annuity industry has consistently tried to gain access to plan participants in order to convince them to invest in various forms of annuities. However, several annuity experts, including annuity industry executives, have noted the inherent inequities in many annuities.8

As a fiduciary risk management counsel, I have adopted a very simple fiduciary prudence process for evaluating investment products, including annuities:

1. Does ERISA expressly require that a plan sponsor offer the specific product be offered within a plan? ERISA Section 404(a) states as follows:

(a) Prudent man standard of care

(1)[A] fiduciary shall discharge his duties…

with the care, skill, prudence, and diligence under the circumstances then prevailing that a prudent man acting in a like capacity and familiar with such matters would use in the conduct of an enterprise of a like character and with like aims;9

Note the absence of any specific mention of annuities, or any other specific type of investment.

2. Would/Could inclusion of the specific product being considered potentially expose the plan and plan sponsor to the risk of unnecessary fiduciary liability?

Prudent plan sponsors do not expose themselves to the risk of unnecessary fiduciary risk. Since ERISA does not expressly require that annuities be offered within a pension plan and annuities present genuine and unnecessary fiduciary risk, I advise my fiduciary risk management clients to avoid annuities altogether. Plan participants who wish to purchase an annuity are obviously free to do so outside the plan.

Based upon my 40+ years of experience, I firmly believe that most plan sponsors, and investment fiduciries in general, needlessly expose themselves to fiduciary breach actions simply because they do not take the time to review valuable resources, such as the Restatement (Third) of Trusts and relevant academic studies which discuss the numerous inherent fiduciary risks associated with annuities. I have written several posts on the inherent fiduciary prudence and fiduciary liability concerns with reagrd to annuities, including my most recent posts here and here.

Legal precedent and current legal decisions are taking on increased importance in designing and maintaining ERISA compliant pension plans. Two current 401(k) fiduciary breach actions, the Matney and Home Depot cases, could dramatically change the current 401(k) and 403(b) fiduciary liability industry. Many ERISA plans are recognizing the value of retaining experienced and knowledgable ERISA counsel to provide fiduciary oversight services as a form of fiduciary liability insurance.

Fixed indeed annuities (FIAs) are the subject of a recent Department of Labor proposal. As mentioned earlier, the annuity indusry has consistently attempted to gain access to pension accounts. The latest strategy is to market indexed annuities as an opportunity to earn higher returns than traditional fixed annuity returns by investing in market indices such as the S&P 500. These higher returns can be converted into “guaranteed income for life.”

As a plaintiff’s attorney for most of my legal career, as well as a former compliance director, I am always interested in “reading between the lines” of contracts and business opportunities to see what’s not being said, looking for potential misrepresentations and other questionable marketing practices.

As a securities complaince director, I could, and still can, see “complaint” written all over indexed annuities due to their complexity and the resulting confusion given the technicalities involved with indexed annuities, including how earned interest is credited to such annuities; the cumulative impact of provisions such as spreads, cap rates and participation rates; and the fact that fixed annuity issuers often reserve the right to change such key terms annually.

Will Rogers’ famous line was that he was not so much worried about the return on his investment as he was on the return of his investment. Will Rogers no doubt would have disliked annuities. Annuity advocates like to repeat the “guaranteed income for life” mantra. As a plaintiff’s attorney, I notice that the annuity issuer does not guarantee a commensurate return, a return of the annuity owner’s principal to breakeven, but rather simply a guarantee of some income for life. This raises several potential issues for plan sponsors and other investment fiduciaries.

This is why I always advise my fiduciary clients, and investors in general, to always require that the agent/broker provide them with a written breakeven analysis. More often than not, a properly prepared breakeven analysis will show that the odds are against an annuity owner even breaking even on their investment. This is due to actuarial concepts such as factoring in both the concept of the present value of money and an owner’s mortality risk, the risk that they will even be alive to receive an annual annuity payment.

The illustration shown is a “pure insurance” breakeven analysis on a $100,000 annuity paying 4 percent interest annually. FIA advocates often object to such breakeven analyses, saying that they do not factor in investment returns.

They have a point. I would argue that their point proves my point in terms of the fiduciary imprudence of annuities in general. At the same time, most plan sponsors will need some supporting doumentation that they can use to (1) meet their personal fiducairy duties to independently investigate and evaluate a plan’s investment options, and (2) fulfill their legal obligation to provide plan participants with “sufficient information to make an informed decision” in order to qualify for the extra liability protection available under ERISA Section 404(c).

In cases where an agent/broker refuses to provide a written breakeven analysis, plan sponsors should always require that they be provided with a written comaprative analysis of the annuity’s relative performance against a comparable market index over sample time periods, e.g., 10 years 20 years, similar to the same performance disclosures currently required for actively managed mutual funds.

Interestingly enough, MassMutual conducted a study shortly after the indexed annuities concept was introduced. They compared a hypothetical indexed annuity with the performance of the S&P 500 index, both with and without dividends, over a thirty year time period. They found that the hypothetical indexed annuity underperformed both versions of the S&P 500 during the time period, with the annuity underperforming the S&P 500 without dividends by approximately 32 percent, and underpeforming the S&P 500 with dividends by approximately 52 percent. They also discovered that over the same time period, even a simple investment in Treasury bond would have outperformed the hypothetical annuity.10

I have argued that empirical evidence similar to the MassMutual study is admissable in cases involving fixed indexed annuities given the fact that indexed annuity issuers often reserve the right to unilaterally change key terms of the annuity annually, terms that directly impact an annuity owner’s end-return.

As a result of this right to annually change the key terms of the annuity, I maintain that indexed annuities are analogous to an actively managed mutual fund.

Based on this analogy, I beleive the fiduciary prudence standards established under the Restatement (Third) of Trusts should be equally applicable in determining the fiduciary prudence of a FIA. Section 90, comment h(2) of the Restatement states that in connection with actively managed investments, it is imprudent to use active management strategies and/or actively managed funds unless it can be ojectively predicted that the active management strategy/fund will provide a commensurate return for the extra costs and risk assumed by an investor.

The odds are against an indexed annuity being able to carry that burden of proof. As Dr. William Reichstein of Baylor University has pointed out, the design of indexed annuities guarantees that an indexed annuity will underperform a comparable benchmark composed of high-grade bonds and options by an amount equal to the combined cost of the annuity’s spread and transaction costs.11

Going Forward

My role as a fiduciary risk management counsel is to alert plan sponsors and other investment fiduciaries as to actual and potential fiduciary liability “traps” and available methods of proactively exposing and avoiding such “traps.” As mentioned earlier, two pending 401(k) actions, the Matney and Home Depot cases, could result in greater fiduciary risk for plan sponsors going forward.

When I speak with plan sponsors about the AMVR metric, as well as the value of forensic fiduciary prudence audits and fiduciary oversight services, the responses are typically along the lines of shrugging the issues off or, even worst, indicating an intent to claim ignorance of the applicable laws and requirements. To plan sponsors planning to use the latter, just remember that judges and regulators like to remind plan spsonsors and other investment fiduciaries that when it comes to alleged breaches of one’s fiducairy duties, “a pure heart and an empty head” are no defense to such claims.

Notes

1. Liss v. Smith, 991 F. Supp. 278, 299.

2. Fink v. National Savs. & Trust Co., 772 F.2d 951, 957, 962 (Scalia dissent) (D.C. Cir. 1985). (Fink)

3. The failure to make any independent investigation and evaluation of a potential plan investment is a breach of fiduciary obligations. Fink, (Fink), In re Enron Corp. Securities, Derivative “ERISA“, 284 F.Supp.2d 511, 549-550, Donovan v. Cunningham, 716 F.2d at 1467.52

4. William F. Sharpe, “The Arithmetic of Active Investing,” available online at https://web.stanford.edu/~wfsharpe/art/active/active.htm.

5. Charles D. Ellis, “Letter to the Grandkids: 12 Essential Investing Guidelines,” available online athttps://www.forbes.com/sites/investor/2014/03/13/letter-to-the-grandkids-12-essential-investing-guidelines/#cd420613736c

6. Ross Miller, “Evaluating the True Cost of Active Management by Mutual Funds,” Journal of Investment Management, Vol. 5, No. 1, 29-49.

7.Uniform Prudent Investor Act, https://www.uniformlaws.org/viewdocument/final-act-108?CommunityKey=58f87d0a-3617-4635-a2af-9a4d02d119c9 (UPIA)

8. Milevsky, M. & Posner, S., “The Titanic Option: Valuation of the Guaranteed Minimum Death Benefit in Variable Annuities and Mutual Funds,” Journal of Risk and Insurance, Vol. 68, No. 1 (2009), 91-126, 92.; Johns, J. D., “The Case for Change,” Financial Planning, 158-168, 158 Johns, J. D. (September 2004); Reichenstein, W., “Financial analysis of equity indexed annuities.” Financial Services Review, 18, 291-311, 291 (2009); Reichenstein, W., “Can annuities offer competitive returns?” Journal of Financial Planning, 24, 36 (August 2011) (Reichenstein)

9. 29 C.F.R. § 2550.404(a)-1; 29 U.S.C. § 1104(a).

10. Jonathan Clements, “Why Big Issuers Are Staying Away From This Year’s Hottest Investment Products,” Wall Street Journal, December 14, 2005, D1.

11. Reichenstein.

Copyright InvestSense, LLC 2023. All rights reserved.

This article is for informational purposes only, and is neither designed nor intended to provide legal, investment, or other professional advice since such advice always requires consideration of individual circumstances. If legal, investment, or other professional assistance is needed, the services of an attorney or other professional advisor should be sought.

You must be logged in to post a comment.