By James W. Watkins, III, J.D., CFP Board Emeritus™, AWMA®

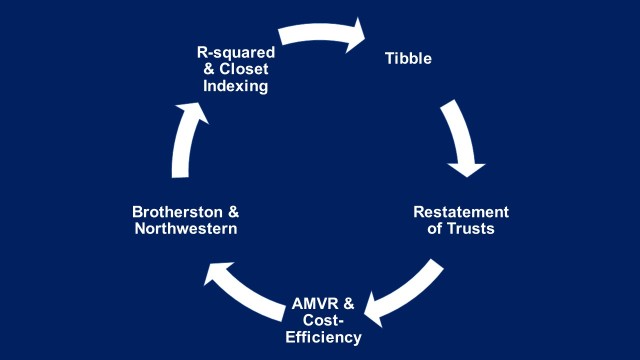

Whenever I meet with a prospective new client, I first explain InvestSense’s “401(k) Fiduciary Prudence Circle,” (FP Circle), one of the cornerstones of our “Fiduciary InvestSense™” process. ERISA and the courts analyze a fiduciary’s decisions in terms of the process used by a plan sponsor in selecting investment options for a plan, not in terms of the ultimate performance of the investment options chosen. The combination of the FP Circle and the Active Management Value Ratio™ (AMVR) provide evidence of both the use of a meaningful process and the compliance of same with applicable legal standards.

We also educate the prospective client on some 401(k)/403(b) fiduciary risk management issues that other consultants usually do not cover. The two AMVR slides below illustrate one of our presentations involving Fidelity Contrafund, a fund found in many defined contribution plans.

The first slide is an AMVR analysis comparing Fidelity Contafund K shares (FCNKX) and the Fidelity Large Cap Growth Fund (FSPGX). Designed to compete with comparable Vanguard funds, FSPGX has done so, both in terms of returns and overall cost efficiency. The issue for plan sponsors is that FSPGX has outperformed FCNKX as well. FSPGX is clearly a more cost-efficient investment option for fiduciaries than FCNKX.

The problem is that Fidelity does not make FSPGX available to defined contribution plans. As a result, plans seemingly settle for FCNKX, despite the obvious fiduciary liability issues due to FCNKX’s comparative cost-inefficiency when compared to other available investment options.

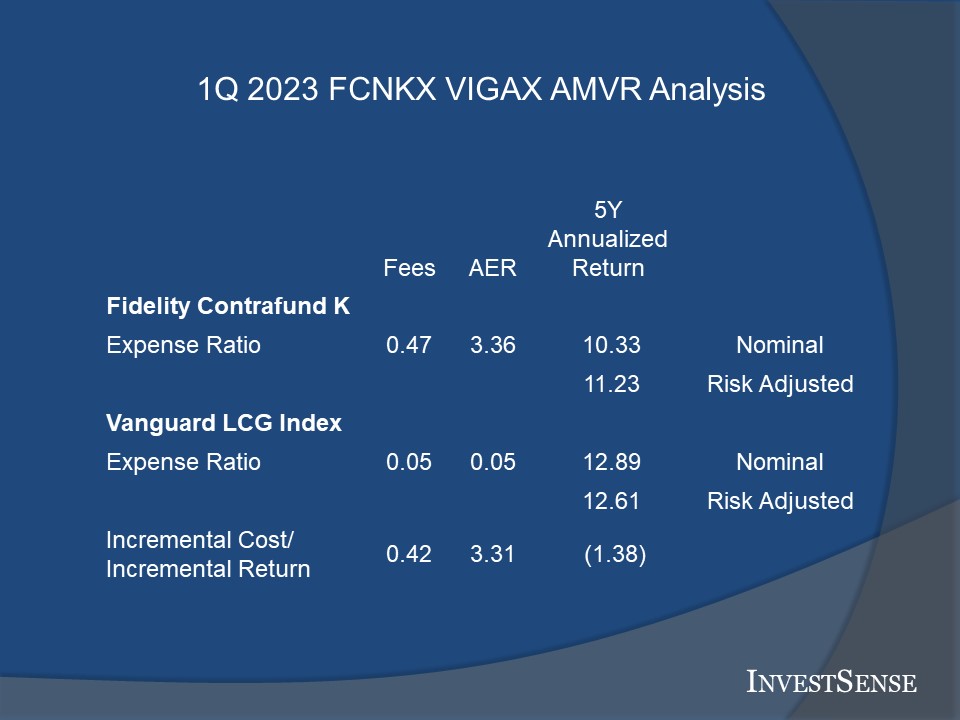

The slide below is an AMVR analysis comparing Fidelity Contafund K shares (FCNKX) and Vanguard’s Large Cap Growth Index Fund Admiral shares (VIGAX). Plans often use Vanguard’s Admiral shares and institutional shares interchangeably given their similarities in terms of cost and performance.

One again, just as with FSPGX, FCNKX proves to be cost-efficient relative to VIGAX. The cost-inefficiency of FCNKX become even worse when Miller’s Active Expense Ratio is used instead of FCNKX’s nominal cost numbers, as shown in the “AER” column.

The need for plans to address these fiduciary prudence and cost-inefficiency issues has become even more important in light of a recent amicus brief filed by the DOL (DOL brief) addressing the issue of which party has the burden of proof with regard to the issue of causation of damages in 401(k)/403(b) litigation. While there is a split within the federal courts on this issue, the DOL’s brief provides a persuasive argument that the burden of proof belongs to plan sponsors, not plan participants.

One of the most persuasive arguments made in support of this position, both in terms of courts decisions and the DOL’s brief, has been that since the legal focus is necessarily on the process used by a plan in making decisions on the plan’s investment options, such information is exclusively within the possession of the plan. This is why the law has consistently stated that plaintiffs are not required to plead a party’s mental processes or state of mind and why the law allows circumstantial evidence to establish same.

Plan sponsors should take note of and review their plans in light of two statements in the DOL’s brief concerning causation of damages:

In short, [a plan sponsor] would have to prove ‘that a prudent fiduciary would have made the same decision.’

If a plaintiff succeeds in showing that ‘no prudent fiduciary’ would have taken the challenged action, they have conclusively established loss causation, and there is no burden left to ‘shift’ to the fiduciary defendant.

As the AMVR slides herein demonstrate, the AMVR can be easily used to establish the relative cost-inefficiency, and, thus, the relative imprudence of an actively managed mutual fund. As a result, if, as expected, SCOTUS eventually rules that the burden of proof on the issue of causation does “shift” to the plan sponsor, that burden might prove to be a very difficult burden to satisfy in many cases.

For further information on the AMVR, click here.

You must be logged in to post a comment.