“Facts are stubborn things; and whatever may be our wishes, our inclinations, or the dictates of our passion, they cannot alter the state of facts and evidence.” – John Adams

He fell at last a victim of the relentless ruless of humble arithmetic. Remember, O stranger: ‘Arithmetic is the first of the sciences and the mother of safety’- Justice Louis Brandeis

Mathematics is the light that reveals the nature of things.”- Justice Louis Brandeis

Closing Argument: Humble Arithmetic, Common Sense, and Fiduciary Prudence vs. In-Plan Annuities

“Facts are stubborn things; and whatever may be our wishes, our inclinations, or the dictates of our passion, they cannot alter the state of facts and evidence.” – John Adams

He fell at last a victim of the relentless ruthless of humble arithmetic. Remember, O stranger: ‘Arithmetic is the first of the sciences and the mother of safety’- Justice Louis Brandeis

Mathematics is the light that reveals the nature of things.”- Justice Louis Brandeis

“May it please the court. At issue in this case is whether the plan sponsor breached their fiduciary duties of prudence and loyalty by including annuities within the company’s 401(k) plan.

The plan argues that its decision to include such annuities was done solely in the best interest of both the plan participants and their beneficiaries, as required under Section 404(a) of ERISA. The plan sponsor claims that the selection and inclusion of the in-plan annuity was done solely to provide plan participants with additional retirement income and added financial security for participants and their beneficiaries. However, the evidence clearly suggests otherwise

During this trial, we have introduced testimony and numerous exhibits that clearly establish that annuities are typically structured to benefit the annuity issuer, not the annuity owner. This is exactly why annuity issuers pay such a high commission to those who can convince a plan to offer annuities within their plan.

The evidence and the mathematics that we have introduced in this case clearly establish that the annuity offered within the plan not only was not in the best interest of the plans’ participants or their beneficiaries, but also that had the plan sponsor performed the legally required independent and objective investigation and evaluation required by ERISA, the resulting harm was easily foreseeable using basic mathematical skills, i.e., humble arithmetic.

Reviewing Exhibit A, a basic Microsoft Excel breakeven analysis on an immediate $50,000 annuity, based solely on present value, paying 3% ($1,500) annually, for a 65 year old woman, with a normal lifetime expectancy (20.7 year). The data indicates that the odds of her reaching the age of 86, are 63%. Should that occur, at age 86, our Excel present value calculation predicts that the annuity owner would have only recovered approximately $18,076.80 , or 36% of her original value. If we assume that the annuity owner chose a “life only” option in order to receive a higher annual distribution payment, that would result in a potential windfall of $31,923.20 for the annuity issuer. Multiply that by the potential number of owners of that particular annuity in the plan and you understand why the annuity industry is trying to make inroads into 401(k) plans and other ERISA pension plans.

The second part of the fiduciary breach equation in this case involves determining whether and when the annuity owner would actually break even by recovering the full amount of her $50,000 original investment. In this case, lets examine the situation if the 65 year old female participant lives to age 100. According to the Social Security Administration (SSA) Period Life Table:

- A 65-year-old woman has about a 3.6% to 4% chance of living to age 100.

Assuming our annuity owner lives to age 100, our present value calculations project that at 100 she would only have recovered $19,000-$20,000 or 3.8-4% of her original investment, resulting in a windfall of $30,000- $31,000 for the annuity issuer.

In this case, our clients have stated that the plan sponsor never disclosed such information, even though ERISA 404(c) requires that a plan sponsor provide plan participants with “sufficient information to make an informed decision.

Annuity advocates point out that plan sponsors are not required to meet the “sufficient information” requirement unless they wish to qualify for the special protections offered under 404(c). However, since plan sponsors are legally fiduciaries, they are required to disclose “all material information” to plan participants.

The courts have consistent defined “material information” as any information which an investor would deem helpful in deciding whether to invest in a product.# I believe that a reasonable investor would consider the foregoing information, the heavy odds against simply breaking even, resulting in the annuity owner subsidizing the annuity issuer rather then the annuity owner’s heirs, “material.”

Exhibit B

As bleak as that breakeven analysis is, a more accurate, and troubling, breakeven analysis is provided by factoring in both present value and mortality rate, the odds that the annuity owner will even be around to receive the annual distribution at a certain age. Going back to Exhibit A, we see that at age 86, the annuity owner would have recovered approximately $15,307, or 30% of her original investment. If we project out to age 100 (odds of 3.6-4%), the annuity owner would have recovered $17,218, or 34% of her original investment, leaving a nice windfall of $34,693 for the annuity issuer. Just as in Las Vegas, annuities are typically structured to ensure that the odds favor the “house.”

During your deliberations, ask yourself, would you consider such information “material” in making a decision as to whether to invest in the annuity. Then ask yourself whether the plan sponsor’s failure to ascertain these facts (a) as part of their legally required thorough and objective investigation and evaluation, and (b) the failure to disclose such information was “in the best interest of both the plan participants and their beneficiaries, or, rather, the third party annuity issuer.

The plan sponsor has admitted that they were not aware of such information and did not perform the necessary calculations themselves, that they blindly trusted the annuity broker’s advice and “expertise.” The courts have consistently warned plan sponsors or the dangers in such situations, especially when the reliance is on a commissioned salesperson:

Defendants relied on FPA, however, and FPA served as a broker, not an impartial analyst. As a broker, FPA and its employees have an incentive to close deals, not to investigate which of several policies might serve the union best. A business in FPA’s position must consider both what plan it can convince the union to accept and the size of the potential commission associated with each alternative. FPA is not an objective analyst any more than the same real estate broker can simultaneously protect the interests of “can simultaneously protect the interests of both buyer and seller or the same attorney can represent both husband and wife in a divorce.#

As the judge will advise you, “a pure heart and an empty head are no defense in a case involving allegations of a breach of fiduciary duties.”# In layman’s terms, there are no mulligans, no do-overs in fiduciary law, If a plan sponsor is unable to perform their legally required fiduciary duties, they have a duty to find someone who is qualified to do so objectively.

Experience shows that too often plan sponsors simply choose to blindly follow the recommendations of product vendors and rely on the pure heart/empty head defense. The dangers involved in adopting this practice were previously addressed in the Gregg decision, in which the court warned plan sponsors of the issues of relying on annuity brokers and other commissioned salespeople

Fortunately, plan sponsors can now use AI to perform a preliminary evaluation of an annuity recommendation. Note: An AI generated breakeven analysis should never be used as a replacement for the legally required investigation and evaluation, but rather as a “red flag’ for the need to obtain the services of a trained, experienced professional who is willing to serve in a fiduciary capacity and provide a written documentation of his breakeven analysis.

Using ChatGPT and the previously discussed data, I generated a breakeven analysis using the following prompt:

Prepare a fiduciary breakeven analysis, in annual intervals, on a $50,000 immediate annuity paying $1,500 a year, factoring in both present value and mortality risk, for a 65 year old woman, assuming normal life expectancy

ChatGPT concluded that:

📌 Breakeven Points

1. Nominal Breakeven (Total Cash = $50,000)

- Reached in: Year 34 (age 99)

- This is when she would have received $50,000 in total cash payments (50,000 ÷ 1,500 = 33.3 years)

This “nominal” breakeven analysis is the typical misrepresentation that the annuity advocates argue and the typical deliberately flawed analysis used by online annuity breakeven calculators and their providers. Just divide the amount of the investment by the interest rate, willfully ignoring the concept of the time value of money.

However, as ChatGPT points out, the legally proper way of constructing a breakeven analysis on an annuity requires that both present value and mortality risk be factored in order to account for both the time value of money and the likelihood of the annuity owner actually being alive to receive the annual annuity payment.

2. Present Value Breakeven

- Total PV of future payments equals $50,000 around year 25–26 (age ~90–91), without mortality, well beyond the annuity owner’s life expectancy.

- But adjusting for mortality, the expected value (EV) of all future payments peaks below $50,000, around $14,600–15,000.

This suggests the “actuarial expected value” of the annuity for a typical 65-year-old woman is around $14,000–15,000, despite the upfront $50,000 cost. This also assumes that the annuity owner chose the “single life” distribution option to maximize the annuity’s distributions.

🎯 Key Takeaways

| Metric | Value |

| Total nominal breakeven (no time discounting) | Age 99 (Year 34) |

| PV breakeven (no mortality) | Age 90–91 |

| EV of annuity (with 3% discount & mortality) | ~$14,600 |

| Life expectancy (female, age 65) | ~20 years |

🧠 Interpretation

- If she lives to 90+, the annuity becomes a good deal in real-dollar terms.

- If she dies earlier, the insurer “wins” (keeps remainder of capital).

- This is the trade-off of longevity insurance—it’s not about individual return maximization, but hedging the risk of outliving assets

So, the odds favor the “house” ultimately receiving the majority of the initial investment at the expense of the annuity owner and their beneficiaries, in blatant violation of ERISA 404(a)’s requirement that plan sponsors act in the best interest of both plan participants and their beneficiaries.

This type of estate asset erosion, loss of estate assets (here, approximately $35,400, or 72%, of the of the original investment, is exactly why estate planning attorneys often refer to annuities as estate planning “saboteurs,” depleting an estate of the assets needed to carry out the decedent’s last wishes. Remember, as fiduciaries, plan sponsors have a duty to disclose all material facts, or, as ERISA section 404(c) states “sufficient information to make an informed decision.” You heard the plaintiffs state that the plan sponsor never met either of these standards.

ERISA requires a plan sponsor to acts as a prudent person would handle their own affairs. Ask yourself, does a prudent person invest $50,000 knowing that the odds are stacked against them, that the likelihood is that they are going to lose $72% of their investment in favor of the annuity company, to essentially subsidize the annuity issuer at the expense of one’s intended heirs.

Equally egregious is the fact that the plan sponsor claims to have included the annuity in the plan to help plan participants receive retirement income, yet admitted that it did not take the time to determine whether the annuity was actually in the best interests of said parties by performing these simple calculations despite the ready availability of such tools. The plan sponsor’s indifference and failure to properly perform the required investigation and evaluation is a blatant breach of their fiduciary duty of loyalty, which requires a plan sponsor to always put the best interests of both the plan participant and their beneficiaries first and foremost, ahead of the best interests of both the plan sponsor and any third parties.

In our example, the plan sponsor stand to receive 76% of the original investment compared to the plan participant’s 24%. I submit to you that such an inequitable result was both clearly foreseeable had the plan sponsor taken the time to properly perform the required investigation and evaluation of the annuity. The law clearly states that in determining whether a fiduciary breach occurred, the plan sponsor will be held liable for what they knew, or should have known, had they simply conducted the proper investigation and evaluation of the investment product.#

Ladies and gentleman, you will have the opportunity to review both the testimony offered in this case, and the charts of our forensic calculations in the jury room during your deliberations. We ask that unlike the plan sponsor, you understand the importance of this case and its consequences upon the financial security of the plaintiffs.

Today, you have more power than you will probably have at any other time in your life. This is the only chance that the plaintiffs have of receiving justice.

The late General Norman Schwartzkop once said

“The truth is that we always know the right thing to do. The hard part is doing it.”

Ladies and gentlemen, that is all the plaintiff is asking of you today. Objectively review and consider the testimony and the evidence in this case, and do the right thing.”

I am frequently asked about the most common fiduciary risk management mistake that i see investment fiduciaries make. By far, the most common mistake I see is the failure to understand what is and is not legally required. As a result, investment fiduciaries constantly expose themselves to unnecessary fiduciary liability.

Often, that is a result of misplaced trust, blindly following the recommendations and advice of parties that do not owe any fiduciary duty to the investment fiduciary. As I have previously posted, NAIC Rule 275, the applicable insurance rule covering fiduciary duties not only does not expressly cover annuities, it expressly exempts ERISA pension plans from requirements of the Rule. As a result an annuity broker can claim to be in compliance with Rule 275, even though the advice and product recommendations provided may actually result in a fiduciary breach for the plan sponsor. This reinforces the need for plan sponsors to heed the warning set out in the Gregg decision.

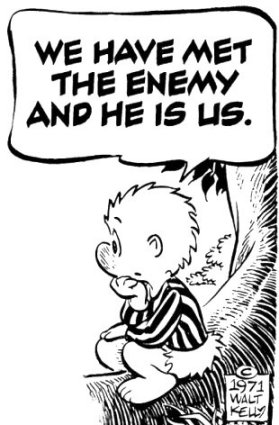

I believe that the situation that many plan sponsors unknowingly may find themselves in is accurately summarized in this snippet from the famous cartoon, “Pogo.”

There is nothing in ERISA or any other law or regulation that expressly requires a plan sponsor to address retirement income or to include annuities providing within a 401(k) or other type of ERISA plan. Furthermore, prudent plan sponsors will realize that such products are available outside the plan, without potentially exposing the plan to fiduciary liability.

As noted fiduciary attorney, Fred Reish, likes to say – “Forewarned is forearmed.” And as I advise InvestSense’s fiduciary risk management clients, “do the math!”

Selah

You must be logged in to post a comment.