James W. Watkins, III, J.D., CFP EmeritusTM, AWMA®

ERISA Section 404a-1 provides as follows:

2550.404a-1 Investment duties.

(a) In general. Sections 404(a)(1)(A) and 404(a)(1)(B) of the Employee Retirement Income Security Act of 1974, as amended (ERISA or the Act) provide, in part, that a fiduciary shall discharge that person’s duties with respect to the plan solely in the interests of the participants and beneficiaries; for the exclusive purpose of providing benefits to participants and their beneficiaries and defraying reasonable expenses of administering the plan; and with the care, skill, prudence, and diligence under the circumstances then prevailing that a prudent person acting in a like capacity and familiar with such matters would use in the conduct of an enterprise of a like character and with like aims.

Based on my experience, too many plan sponsors who are considering or have included in-plan annuities as an investment option within their plan have either overlooked or have not properly assessed the potential fiduciary liability risks presented by the inclusion of the “and their beneficiaries” language.

The most obvious concern for a plan sponsor should be with the possibility of an in-plan annuity resulting in an erosion of estate assets. Annuity advocates frequently point to available options such as annuity riders to protect against estate asset protection. Unless the annuity issuer iss providing such riders for free (they don’t), then the additional costs further reduce returns and estate assets. As SCOTUS pointed out in Hughes v. Northwestern University1, each investment option within a plan must be individually prudent, must stand on its own.

That would presumably rule out the added costs of the “bells and whistles suggested by the annuity industry. After all, as both the DOL and GAO studies2 pointed out, over a twenty year period, each additional 1 percent in fees and costs reduces an investor’s end-return by approximately 17 percent. It does not take much for cumulative costs on annuities to exceed 3 percent annually, at which point the annuity becomes a better investment for the annuity issuer than the plan participant, and grounds for a fiduciary breach action against a plan sponsor.

The annuity industry loves to use head games to sell their product. They used the “squandering plaintiff” ruse in an attempt to convince courts to require structured settlements in cases involving significant damage payments. Attorney Jeremy Babener exposed that ruse by pointing out that there was no verifiable evidence of the evidence cited by the industry, with the general counsel essentially admitting that the “evidence” cited by the industry were simply made up to help promote the industry.3

Currently we have some annuity advocates attempting to manipulate plan sponsors and other investment fiduciaries by reportedly suggesting that they have a legal obligation to offer annuities within a plan. Other questionable annuity marketing strategies involving plan sposnors include recommending annuities for decumulation purposes. Let’s set the record straight:

- There is no legal foundation for the suggestion that ERISA or any other law requires a plan to offer annuities within plan.

- There is no legal foundation for the suggestion that ERISA or any other law requires a plan to offer any specific type of investment. ERISA simply requires that each investment offered within a plan be legally prudent.

- There is no legal foundation for the suggestion that plan sponsors have any legal obligation with regard to assisting in the decumulation of a plan account, whether by providing products or advice. In fact, providing advice and/or assistance can be grounds for holding that an otherwise non-fiduciary party has crossed the line and is legally a fiduciary.

Annuity advocates claim that my positions are cruel and insensitive. My response – my advice is legally prudent and consistent with both prudent fiduciary risk management strategies. Furthermore, the alleged “humanitarian” argument currently being advanced by the annuity industry is extremely ironic coming from an industry marketing a product that is intentionally designed to produce a windfall for the annuity issuer at the expense of both the plan participant and their beneficiaries.

Ironic coming from an industry that consistently opposes any type of a meaningful fiduciary standard that would simply require that the industry always act in the best interests of the public. Ironic coming from an industry that, as Judge Barbara Lynn pointed out, markets annuity products that reserve the right of the annuity issuer to unilaterally change key terms of the annuity, after the fact, so as to shift the risk of the investment from the annuity issuer to the annuity owner.4

Plan sponsors, plan participants and their beneficiaries would be better served by ignoring the annuity industry’s questionable marketing startegies and heeding the advice of Jack Welch, former CEO of GE – “Don’t make the process harder than it is.” Yet, far too many plan sponsors do just that, resulting in unnecessary fiduciary liability exposure.

Another marketing strategy currently being used by the annuity industry is to suggest that plan sponsors have a moral duty to offer annuities within a plan because plan participants supposedly “want” to buy them. As soon as I hear the “participants want them” argument, my immediate reaction is “tell me that you know nothing about fiduciary law without telling me that you know nothing about fiduciary law.” I even had a well-known annuity advocate tell me that someone cannot be a fiduciary without offering annuities. That simply is not true.

I sometimes receive requests to sit in on plan investment committee meeting to offer fiduciary risk management advice. Whenever an annuity wholesaler is going to make a presentation, I “woodshed” plan’s investment committee so they know how to evaluate the wholesaler and their sales pitch. In following Steve Job’s advice to always include a “Holy S**t” moment, I always tell the committee to ask the wholesaler if they are willing to submit a written breakeven analysis of any recommended annuities.

The wholesaler will usually decline and immediately object, “that’s not required by law,” or offer to provide a verbal breakeven analysis. Plan sponsors should always insist on a written breakeven analysis, as it should be admissible in court, if necessary. Amazing how facts often change under stress.

To summarize, plan sponsors should always remember Jack Welch’s advice. I have a saying for my clients – KISS – Keep It Simple and Smart. Simple refers to the fact that the more investment option a plan offers, the greater the likelihood of a breach. ERISA only mentions a required number of investment options once, as in a minimum of three broadly diversified investment options are required for plans looking for the protection offered under 404(c). For a long time, the federal government’s highly successful Federal Thrift Plan (FTP) only offered five, diversified index-type investment options. As a result, they offered federal employees an easily understandable and effective plan, while protecting against “paralysis by analysis.” Today, the FTP boasts a number of millionaires.

As for the “smart” part of the equation, I recommend evaluating investment options with simple cost-benefit analysis {CBA}. Obviously, I prefer the Active Management Value Ratio (AMVR) metric I created for my fiduciary risk management consulting firm, InvestSense, LLC. The AMVR is essentially a cost-benefit analysis using incremental risk-adjusted returns and incremental correlation-adjusted costs as the input data. Based on the investment concepts investment icons such as Nobel laureate Dr. William F. Sharpe and Charles D. Ellis, the metric is fundamentally sound and simple to use. Further information on the AMVR and sample analyses can be found at fiduciaryinvestsense.com.

Going Forward

Based on my conversation with fellow ERISA plaintiff’s counsel, I expect to see an increase in litigation based on the “and their beneficiaries” language of ERISA Section 404a. It would appear to be the proverbial “low hanging fruit” in litigating fiducairy breach actions. To that end ,I submitted the following query to ChatGPT:

Using cost-benefit analysis, prepare a fiduciary prudence analysis of a $50,000 immediate annuity, paying 5% annually, on a 65 year old woman, assuming normal life expectancy, factoring in commensurate return, breakeven analysis, estate asset erosion, present value and mortality risk concerns, as well the best interest of the plan participants and their beneficiaries.

I am not going to post the chat ChatGPT generated report here due to its length. The reader can submit the same query and presumably receive the same analaysis. However, with one notable exception, the report’s findings, conclusions, and recommendations agree with my findings and analysis. The exception involved the report’s use of a “nominal”breakeven point, which is nothing more than dividing the face value of the annuity by its interest rate. Here, the ChatGPT reported a nominal breakeven point of 10 years, Most courts would not such a deliberatively misleading analysis into evidence.

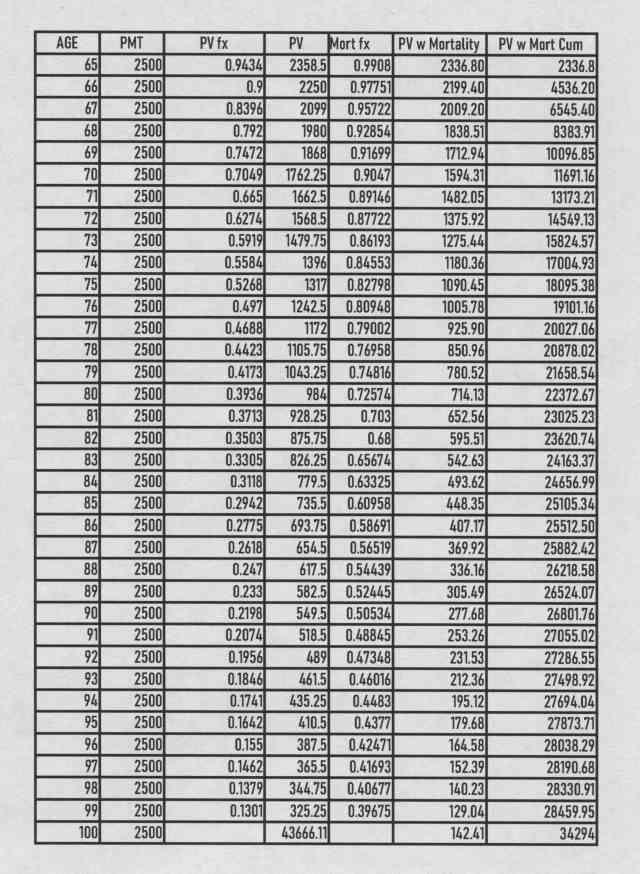

A properly prepared annuity breakeven analysis should always factor in present value and mortality risk .In legal actions involving significant damages, the defendant will generally seek a structed settlement in which the majority of such damages be covered by an annuity. A plaintiff’s attorney needs to understand how to properly evaluate any proposed settlement involving an annuity to ensure that the proposed settlement is actually in the plaintiff’s best interest. An attorney who recommends that a plaintiff accept a structured settlement at a certain price, needs to be sure the represented settlement price is accurate. In our “and their beneficiaries” scenario, I personally ran a breakeven analysis using the previously mentioned facts. The results of that analysis are shown below.

The chart shown is for informational and teaching purposes only and the data and analysis does not represent a specific person or situation and is not intended to be used, and should not be used, in any specific situation, as each client situation involves a unique set of facts and circumstances. Investors needing presonal advice should consult with an experienced professional such as an attorney and/or actuary.

Assuming a normal life expectancy of 86 years (65+20.7), the accumulated present value of the annuity would only be $25,512, resulting in an estate asset loss of $24,487, constituing an estate asset erosion of 48.97 percent. So much for any alleged fiduciary prudence of the annuity option and compliance with the “and their beneficiaries ” requirement of ERISA 404(a). Given the fact that offering an annuity option, in any form, is not legally required, the obvious fiduciary risk management question is – “Why go there?”

Plan participants interested in annuities can always pursue their interest outside of the plan, without exposing the plan to unnecessary liability. After all, the best startegy for managing fiduciary risk is to avoid such risk altogether whenever possible. Where do I go to reommend a new regulation that requires that any and all recommendations involving an annuity to plan sponsors, as well any investment fiduciary, must be accompanied with a properly prepared written breakeven analyses, one that factors in both present value and mortality risk considerations? Even better, how many annuity advocates would be willing to support such an equitable measure?

Notes

1. Hughes v. Northwestern University, 595 U.S. ___, (2022)/

2. Pension and Welfare Benefits Administration, “Study of 401(k) Plan Fees and Expenses,” (DOL Study) http://www.DepartmentofLabor.gov/ebsa/pdf; “Private Pensions: Changes needed to Provide 401(k) Plan Participants and the Department of Labor Better Information on Fees,” (GAO Study).

3. Jeremy Babener, “Justifying the Structured Settlement Tax Subsidy: The Use of Lump Sum Settlement Monies,” NYU Journal of Law and Business Vol 6 (Fall 2009), 129. (Babener)

4. Chamber of Commerce of the United States of America v. United States Department of Labor, 231 F. Supp.3d 152 (N.D. Tex 2017). (District Court).

© Copyright 2025 InvestSense, LLC. All rights reserved

This article is for informational purposes only and is neither designed nor intended to provide legal, investment, or other professional advice since such advice always requires consideration of individual circumstances. If legal, investment, or other professional assistance is needed, the services of an attorney or other professional advisor should be sought.

You must be logged in to post a comment.