James W. Watkins, III, J.D., CFP EmeritusTM, AWMA®

With all the recent SCOTUS decision in Cunningham v. Cornell University1, there has been a lot of discussion about Prohibited Transactions and Prohibited Transaction Exemptions (PTEs). That is understandable; however, it is important for plan sponsors not to overlook the traditional fiduciary duties of fiduciary prudence and loyalty.

As a fiduciary risk management counsel, I offer fiduciary audits and plan reviews. Unfortunately, I often find that plans are unknowingly exposed to unnecessary fiduciary liability due to legally insufficient fiduciary processes. The problems are typically due to a lack of understanding as to what fiduciary status requires and/or a lack of experience and/or knowledge about certain investments.

With our clients, we stress the importance of selecting cost-efficient investment options. To help them accomplish this goal, we teach them about the simplicity and benefits of cost-benefit analysis.

Companies around the world routinely use cost-benefit to evaluate proposed projects. However, my experience has been that the financial services industry and its agents typically do not use cost-benefit analysis in evaluating investment options. Why? Because, more often than not, cost-benefit analysis will reveal that actively managed mutual fund investments are not cost-efficient when compared to comparable passivley managed index funds.

For over twenty years, I served as a compliance professional for broker-dealers and insurance companies. As I got a better understanding of those businesses, I gained a greater understanding of their “tricks of the trade,” ” and how to properly deal with them.

Several years ago, I created a simple metric, the Active Management Value Ratio™ (AMVR). The AMVR is based on the research and concepts of investment icons such as Nobel laureate Dr. William F. Sharpe, Charles D. Ellis, and Burton G. Malkiel.

/quote

The best way to measure a manager’s performanceis to compare his or her return with that of a comparable passive investment.2

So, the incremental fees for an actively managed fund relative to its incremental returns shoud always be compared to the fees for a comaprable index fund relative to its returns. When you do this, you’ll quickly see that the incremental fees for active management are really, really high – on average, over 100 of incremental returns.3

Past performance is not helpful in predicting future returns. The two variables that do the best job in pedicting future performance [of mutual funds] are expense ratios and turnover.4

So, the incremental fees for an actively managed mutual fund relative to its incremental returns should always be compared to the fees for a comparable index fund relative to its returns. When you do this, you’ll quickly see that the incremental fees for active management are really, really high – on average, over 100% of incremental returns.

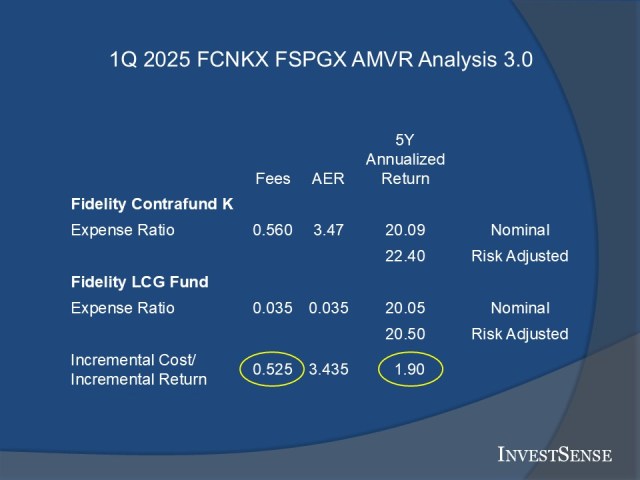

The AMVR is essentially a cost-benefit analysis using incremental cost and incremental returns, or versions thereof, in performing the analysis. Shown below are sample slides showing the basic AMVR analysis process.

Using purely nominal numbers, FCNKX’s incremental benefit does exceed its incremental costs. But a good ERISA plaintiff’s attorney will argue that a more accurate analysis of fiduciary prudence is provided by using the incremental return numbers obtained by applying Ross Miller’s Active Expense Ratio (AER), which factors in the correlation of returns between two mutual funds. Miller explains the value of his AER metric as follows:

Mutual funds appear to provide investment servicws for relatively low fees because they bundle passive and active funds together in a way that understates the true cost of active management. In particular, funds engaging in ‘closet’ or ‘shadow’ indexing charge their investors for active maangement while providing them with little more than an indexed investment. Even the average mutual fund, which ostensibly provides only active management, will have 90% of the variance in its returns explained by its benchmark index.5

So, essentially, the higher the correlation between an actively managed fund and a comparable index fund, the less likely the value of active management, if any, being provided by the actively managed fund.

Using the AER, an argument can be made that FSPGX is the much better choice in terms of fulfilling a plan sponsor’s fiduciary duties. The fact that FSPGX and FCNKX are offered by the same mutual fund company, Fidelity, and belong to the fund category, large cap growth, makes that analysis even more compelling. At the very least, an argument should be made that a plan sponsor should inquire into the availability of FSPGX for the plan rather than Fidelity Contrafund fund, which ironically is one of the most common mutual funds found in 401(k) plans. When I review plans, one of the first things I look for is whether Fidelity Contrafund is offered within the plan. Humble Arithmetic, as John Bogle was fond of saying.

So, if Fidelity refuses to offer FSPGX to a plan, what should the plan sponsor’s response be? A simple fiduciary risk management principle we teach our clients is that a fiduciary can never “settle.” “Settling” is the antithesis of a fiduciary’s “best interest” duty under the fiduciary duty of loyalty.

A prudent plan sponsor looking for cost-efficient options for a plan should always do an AMVR analysis using a comparable Vanguard index fund. I know various courts and judges dismiss Vanguard funds, some claiming you cannot compare “apples and oranges.”

That is absurd, simply a ruse to protect the cost-inefficient actively managed mutual fund industry. In fact, one of the primary benefits of using cost-benefit analysis in fiduciary prudence analysis is that it allows fiduciaries to compare investments based purely on an objective basis, cost-efficiency. Furthermore, Section 100 of the Restatement (Third) of Trusts recognizess the validity of comparing actively managed funds with comparable index funds.6 Judge Kayatta cited Section 100 of the Restatement in his opinion in Brotherton v. Putnam Investments LLC.7 As for Vanguard index funds specifically, Judge Sidney Stein, the well-respected district court judge for the Southern District of New Yor,k aka the Wall Street federal Court, has recognized the validity of using Vanguard index funds as comparators in forensic analysis.8

In the AMVR analysis shown for FCNKX and VIGAX (Vanguard Large Cap Growth Index Fund), based purely on the nominal, or publicly reported, numbers, VIGAX, is the more prudent option due to anpositive incremental risk-adjusted return (0.07) that is also less than the incremental cost between the two funds (0.51). If we base the comparison on the AER correlation-adjusted costs, the prudence of the VIGAX is even clearer (3.26 v 0.07).

In both of the comparisons shown, the correlation of returns between the two funds was 97. Surprisingly, such a high correlation of returns is not unusual today, as claims of “closet index” funds is a much-debated issue, not only in the U.S., but internationally as well. Canada and Australia have been the leaders in studying the existence and impact of closet index funds.

The AMVR itself, both the calculation and interpretation process, are very simple. Just divide the incremental cost between the funds by the incremental return between the funds. Since cost-efficiency is the goal, an AMVR score greater than 1.00 indicates that the actively managed fund is cost-inefficient relative to the comparator index fund. Actively managed funds that do not provide a positive incremental return should be automatically disqualified from consideration, since they will automatically be cost-inefficient and imprudent.

One of the “secret” benefits of using the AMVR metric is that it automatically reveals the unrewarded premium that a plan participant would be paying. That premium is common used by plaintiff’s attorneys in ERISA actions in calculating damages in a trial. An AMVR score of 1.25 would indicate a premium of 25% per share. Multiply the shares in the plan by the premium to determine the damages due to the inclusion of a particular fund within a plan.

The good news is that a plan sponsor can limit any potential fiduciary liability in connection with mutual funds and similar investment, e.g., TDFs, by using the AMVR to evaluate competing investment options for a pension plan. I used the AMVR in a case to compare the index-based version of Fidelity’s TDFs with the actively managed versions of the same TDFs.

ERISA plaintiff’s attorneys are well aware of the AMVR. Hopefully, your plan will never be involved in fiduciary litigation. However, if so, do not be surprised to see the familiar AMVR slide format at trial.

A prudent plan sponsor looking for cost-efficient options for a plan should always do an AMVR analysis using a comparable Vanguard index fund. I know various courts and judges dismiss Vanguard funds, some claiming you cannot compare “apples and oranges.”

That is an absurd assertion and a ruse to protect the cost-efficient actively managed mutual fund industry. In fact, one of the primary benefits of using cost-benefit analysis in fiduciary prudence analysis is that it allows fiduciaries to compare different kinds of investments with each other based purely on cost-efficiency. Furthermore, Section 100 of the Restatement (Third) of Trusts authorizes the validity of comparing actively managed funds with comparable index funds.9 Judge Kayatta cited Section 100 of the Restatement in his opinion in Brotherton v. Putnam Investments LLC.

So to determine whether there was a loss, it is reasonable to compare the actual returns on that portfolio to the returns that would have been generated by a portfolio of benchmark funds or indexes comparable but for the fact that they do not claim to be able to pick winners and losers, or charge for doing so. Restatement (Third) of Trusts, § 100 cmt. b(1) (loss determinations can be based on returns of suitable index mutual funds or market indexes).10

As for Vanguard index funds specifically, Judge Sidney Stein, the well-respected district court judge for the Southern District of New York aka the Wall Street Court, has supported the use of Vanguard index funds.11

In the AMVR analysis shown for FCNKX and VIGAX (Vanguard Large Cap Growth Index Fund), based purely on the nominal, or publicly reported numbers, VIGAX, is the more prudent option due to an incremental risk-adjusted return (0.07) that is less than the incremental cost between the two funds (0.51). If we base the comparison on the AER correlation adjusted costs, the prudency of the VIGAX is even clearer (3.26 v 0.07).

In both of the comparisons shown, the correlation of returns between the two funds was 97. Surprisingly, such a high correlation of returns is not unusual today, as claims of “closet index funds” is a much-debated issue, not only in the U.S., but internationally as well. Canada and Australia have been the leaders in studying the existence and impact of closet index funds.

The AMVR itself, both the calculation and interpretation are very simple. Just divide the incremental cost between the funds by the incremental return between the funds. Since cost-efficiency is the goal, an AMVR score greater than 1.00 indicates that the actively managed fund is cost-inefficient relative to the comparator index fund. Actively managed funds that do not provide a positive incremental return should be automatically disqualified from consideration, since they will automatically be cost-inefficient.

One of the “secret” benefits of using the AMVR metric is that it automatically indicates the unrewarded premium that a plan participant would be paying. That premium is a plaintiff’s attorney would use in calculating damages in a trial. An AMVR score of 1.25 would indicate a premium of 25%, or 25 basis points on each share. Multiply the shares in the plan by the premium to determine the damage due to a particular fund.

The good news is that a plan sponsor can limit any potential fiduciary liability in connection with mutual funds and similar investments by using the AMVR to evaluate competing investment options for a pension plan. The AMVR can even be used to evaluate the prudence of individual elements of TDF funds.

ERISA plaintiff’s attorneys are well aware of the AMVR. Hopefully, your plan will never be involved in fiduciary litigation. However, if so,, do not be surprised to see the familiar AMVR slide format at trial.

Going Forward

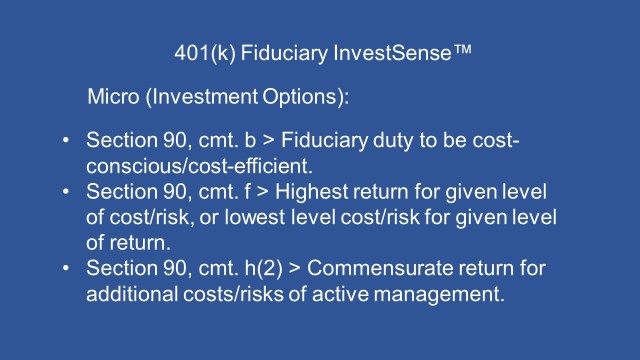

A basic understanding of the core principles set out in the Restatement (Third) of Trusts is an absolute necessity for prudent plan sponsors and other investment fiduciaries. In my opinion, three key comments in Section 90 of the Restatement, aka The Prudent Investor Rule, are shown in the box below.

We tell our clients that if they simply remember and apply these three concepts in their practices, they will greatly reduce the risk of unwanted fiduciary liability exposure. Time has proven that advice to be true.

When I think of fiduciary risk management, I think of a quote by the late General Norman Schwarzkopf. I always used this quote in my closing argument to the jury.

The truth of the matter is that you always know the right thing to do. The hard part is doing it.

Notes

1. Cunnigham v. Cornell University, Supreme Court Case No. 23-1007 (2024).

2. William F. Sharpe, “The Arithmetic of Active Investing,” available online t https://web.stanford.edu/~wfsharpe/art/active/active.htm.

3. Charles D. Ellis, “Letter to the Grandkids: 12 Essential Investing Guidelines,” https://www.forbes.com/sites/investor/2014/03/13/letter-to-the-grandkids-12-essential-investing-guidelines/#cd420613736c

4. Burton G. Malkiel, “A Random Walk Down Wall Street,” 11th Ed., (W.W. Norton & Co., 2016), 460.

5. Ross Miller, “Evaluating the True Cost of Active Management by Mutual Funds,” Journal of Investment Management, Vol. 5, No. 1, 29-49 (2007). https://papers.ssrn.com/sol3/papers.cfm?abstract_id=746926.

6. Restatement (Third) of Trusts, Section 100, American Law Institute. All rights reserved.

7. Brotherston v. Putnam Investments, LLC, 907 F.3d 17, 31, 39 (2018). (Brotherston)

8. Leber v. Citigroup 401k Plan Investment Committee, 2014 WL 4851816.

9. Restatement (Third) of Trusts, Section 100, American Law Institute. All rights reserved.

10. Brotherston, 31, 39

11. Leber v. Citigroup 401k Plan Investment Committee, 2014 WL 4851816.

© Copyright 2025 InvestSense, LLC. All rights reserved.

This article is for informational purposes only and is neither designed nor intended to provide legal, investment, or other professional advice since such advice always requires consideration of individual circumstances. If legal, investment, or other professional assistance is needed, the services of an attorney or other qulified professional advisor should be sought.

You must be logged in to post a comment.